- French Tech Updates

- Posts

- 🇫🇷 French Tech Updates — January 12, 2026. €62.28M in new funding for French companies.

🇫🇷 French Tech Updates — January 12, 2026. €62.28M in new funding for French companies.

What you need to know this week in France: 🦾 Mistral doubles down on defense 🕵️♂️ France opens criminal investigation into Grok AI, 👗 Vestiaire Collective leadershop shakeup.

Welcome to French Tech Updates! Your weekly source of startup, VC, and tech news and insights. I’m James, a startup-obsessed American living in Paris.

Hello 2026

Welcome back to the first regularly-programmed post of 2026. This year is already off to an interesting start with over €60 million in new funding announcements, corporate ousters, criminal investigations, and a new major defense partnership for Mistral.

Before fully moving on to the new year, I thought it might be fun to take one last trip back through 2025. If you read last week’s 2026 French Tech Funding Report you can now also test your knowledge with this 15 question quiz.

How well do you know French tech? Click the link or the image below to find out.

And with that, let’s dive in!

What’s new this week in 🇫🇷

Sixteen years after co-founding the secondhand luxury goods marketplace with Sophie Hersan, Fanny Moizant is being ousted in what she described as “neither a decision I made, nor one I expected.” Mizant, who was previously awarded the National Order of Merit for her work in the company, announced her exit on LinkedIn in a message where she thanked both Hersan and former Vestiaire Collective CEO Maximilian Bittner.

However, one person was conspicuously absent from any messages of gratitude: current CEO Bernard Osta. Osta, who assumed the CEO role last October, is reportedly driving a shift in the company towards further international expansion and an increased reliance on AI tools for buyers and sellers. Both the company and Moizant have declined to comment further on the reasons behind her departure.

The great French AI hope Mistral has signed a framework agreement with the Ministry of the Armed Forces which will provide the French military with access to its models and software on sovereign infrastructure. The deal, managed by France’s defense AI agency, reflects a broader push in Europe for technological autonomy amid growing wariness of U.S.-owned platforms.

Last year, Mistral made their first major move into defense by partnering with the €12 billion German defense tech Helsing to co-develop autonomous an AI-assisted battlefield systems.

French prosecutors have opened an investigation into Grok, X’s AI chatbot, after hundreds of women and teenagers reported their photos had been digitally “undressed” without consent.

Lawmakers Arthur Delaporte and Eric Bothorel filed formal complaints, calling the deepfakes a violation of dignity, and government ministers have flagged the content as “manifestly illegal.” The case expands an existing probe into X, which is already under investigation in France for antisemitic content and Holocaust denial.

🌍 Headlines from around the world

🥊 Trillionaire vs. Billionaire : Elon Musk’s lawsuit against OpenAI is headed to a jury trial in March (The Guardian)

📉 (Meanwhile) xAI raised $20 billion despite losing $1.46 billion per quarter (CNBC)

💶 Antler’s U.S. fund raised $160 million (WSJ)

🤖 Amazon’s Alexa takes to the web (and eventually to France) as Alexa+ (BFM)

🌁 a16z has raised $15 billion across more than 6 funds (a16z)

🛍️ Google announced a new protocol to facilitate commerce using AI agents (TechCrunch)

☢️ Meta signed deals with three nuclear power providers to energize its AI plans (CNBC)

🤑 Lux Capital raised $1.5 billion for its largest fund yet (TechCrunch)

🇪🇺 EU regulators are reportedly preparing to rollback planned regulations on big tech companies (Semafor)

🌍 Flutterwave acquired Nigerian open banking startup Mono (Finovate)

New Funding 💶

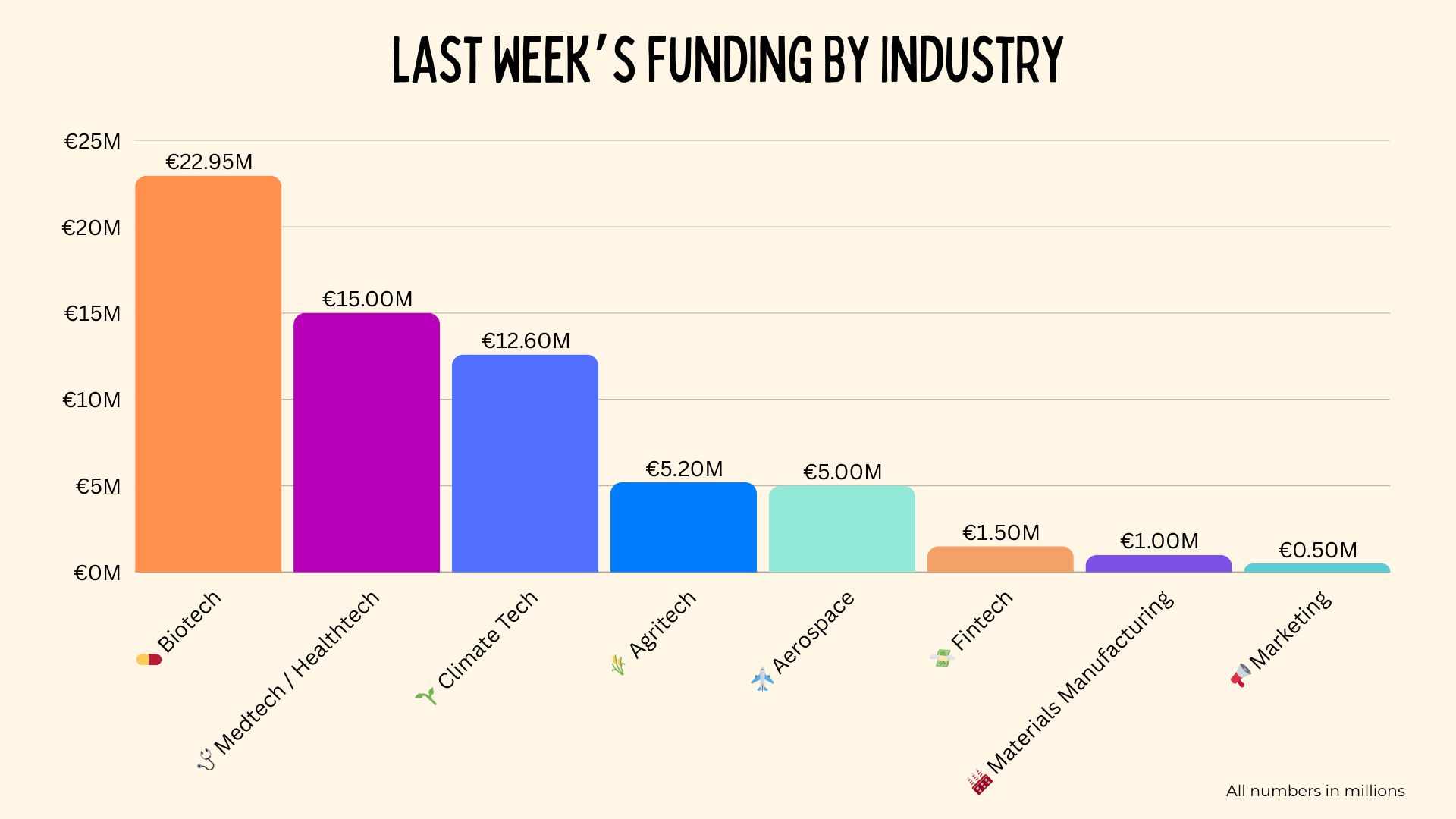

9 companies announced €62.28 million in new funding last week including €1M in crowdfunding by Anodine (🏭 Materials Manufacturing) and €500K by myDid (📢 Marketing).

Sweetech | €2.25M | 🧬 Biotech

Toulouse-based Sweetech raised €2.25 million in a Seed round from Iron Hands Capital and Bpifrance. The startup develops a fermentation-based process to produce rare sugars used in pharmaceuticals, cosmetics, and nutraceuticals. The funding will support pilot production, customer acquisition, and R&D as Sweetech aims to scale its green alternative to synthetic sugar chemistry.

Cementic | €4M | 🦷 Healthtech

Paris-based Cementic raised €4 million in a Seed round led by Blast, with backing from dental professionals. The startup is developing a nanomaterial for root canal fillings that eliminates 99.99% of lingering bacteria, aiming to reduce post-treatment infections and the need for antibiotics. Clinical trials in French dental clinics are set to begin this year, with a U.S. market launch targeted within six months.

Kepplair Evolution | €5M | ✈️ Aerospace

Toulouse-based Kepplair Evolution raised €5 million to convert ATR 72 aircraft into water bombers for fighting wildfires. The startup’s retrofit project promises faster development and lower costs compared to building new planes, and has already caught the attention of France’s civil protection agency. The first two aircraft are slated for delivery before the 2027 fire season.

Quideos | €5.2M | 🌾 Agritech

Paris-based Quideos raised €5.2 million led by Demeter and Breega, with Crédit Agricole joining in. The startup helps farmers and agri-food businesses protect against wild price swings in unlisted agricultural products like fruit, vegetables, and meat by offering hedging contracts that fix prices in advance. With regulatory approval now secured, Quideos now aims to scale its operations across France and eventually Europe.

BrightHeart | €11M | 🩺 Medtech

Paris-based BrightHeart raised €11 million in a Series A round co-led by Odyssée Venture and GO Capital. The company develops AI software that helps OB-GYNs detect congenital heart defects during routine prenatal ultrasounds. With five FDA clearances already under its belt, BrightHeart plans to use the funding to expand in the U.S. and Europe.

Equitable Earth | €12.6M | 🌱 Climate Tech

Equitable Earth raised €12.6 million in fresh funding to scale its certification platform for nature-based carbon projects. Backed by a US family office and existing investors AENU, noa, and Localglobe, the startup is aiming to become the global standard in carbon project verification, with a focus on transparency, community impact, and ecological integrity. The funding will go toward certifying millions more hectares and expanding their tech and team.

Enodia Therapeutics | €20.7M | 💊 Biotech

Paris-based Enodia Therapeutics raised €20.7 million in a Seed round co-led by Elaia, Pfizer Ventures, and Bpifrance. The startup is developing small molecule drugs that trigger the degradation of disease-causing proteins right as they’re being made, using a proprietary platform combining proteomics and machine learning. The funds will advance their lead program toward preclinical candidate selection, with broader ambitions in inflammatory, autoimmune, and viral diseases.

Upcoming Events 🗓

🆕 REX: Introduction au protocole Agent 2 Agent – January 12

🆕 Data Acceleration Guild: Talk To My Data – January 13

🆕 Le secret pour valoriser une entreprise – January 14

🆕 Lancement d'Impulse Healthcare, par Bayes Impact – January 19

🆕 2 ans Raise Sherpas Association X Climate House – January 20

🆕 SheEOs x Sistafund x Sowefund – January 20

🆕 Data, Compute & AI : L’avenir du temps réel à grande échelle – January 22

🆕 From visibility to credibility: building a lasting reputation in AI – January 27

🆕 Maddy Invest Awards – February 19

Interesting Jobs 👩💻

What Else I’m Reading 📚

Social Capital in Silicon Valley (Alex Danco)

5 Simple Ideas That Can Change Your Life (Mark Manson)

At least five interesting things: Debunking the Debunkers edition (#73) (Noahpinion)

TechpressoWhy you’ll like it: Daily updates on the latest tech and AI news in an easy-to-read format. Stay in the know while finishing your morning coffee. | A Smart Bear: LongformWhy you’ll like it: Practical insights from building two unicorn companies, covering product, growth, prioritization, and much more. |