- French Tech Updates

- Posts

- 🇫🇷 2025 French Tech Funding Report

🇫🇷 2025 French Tech Funding Report

🗞️ Where did VCs invest €7.2B of capital last year? Get the full list of 542 companies covered in French Tech Updates last year + our full-year 2025 report for French tech funding.

Welcome to a special edition of French Tech Updates! Normally, this newsletter is your weekly source of startup, VC, and tech news and insights written by me, James— startup-obsessed American living in Paris. In this special edition, we’re taking a closer look at all the fundraising news from last year.

Bonne Année

Whether you were in Paris during the snow or traveling to see family and friends I hope the last few weeks were happy, healthy, and restful.

The end of the year is usually a time for reflection, and there was a lot to reflect on from 2025. In this special edition of the newsletter, we’re doing some introspection of our own on what the year meant for French startups and investors.

Read on to see where capital is flowing, what lies below the AI hype, and to get the complete list of all 542 companies covered in French Tech Updates year.

Let’s dive in!

Table of Contents

Source: French Tech Updates

🏆 A 2025 comeback story

Starting with the headline number, funding was up in 2025 vs. 2024—way up.

The €7.93 billion raised by French companies in 2025 represents a 55% increase compared to 2024’s total of €5.08 billion (nickel!).

Even if you strip out Mistral’s €1.7 billion monster round, total funding for 2025 would still up 22% year over year.

Source: French Tech Updates

While funding increased across all deal sizes, mega-rounds in the €50M or higher range continued to pull in a greater amount of the capital pool, rising to 58% of all funds raised in 2025 vs. 47% in 2024.

Speaking of mega-rounds, we have to come back to Mistral.

The AI darling’s €1.7 billion Series C in September captured an eye watering 21% of all capital raised in France during 2025 and marked the 2nd year in a row that Mistral raised the most of any French startup. For comparison, last year the company’s €468 million Series B snapped up 9% of all capital deployed in France during 2024.

Because Mistral’s Series C distorts the data so much, in a few charts later on I’m going to show results with and without it included to get a better sense of the underlying trends.

📊 Key Figures

💶 €7.93B in total funding📈 €6.2B announced for VC funds | 🗞️ 542 deals covered🦄 21% of capital went to Mistral |

Source: French Tech Updates

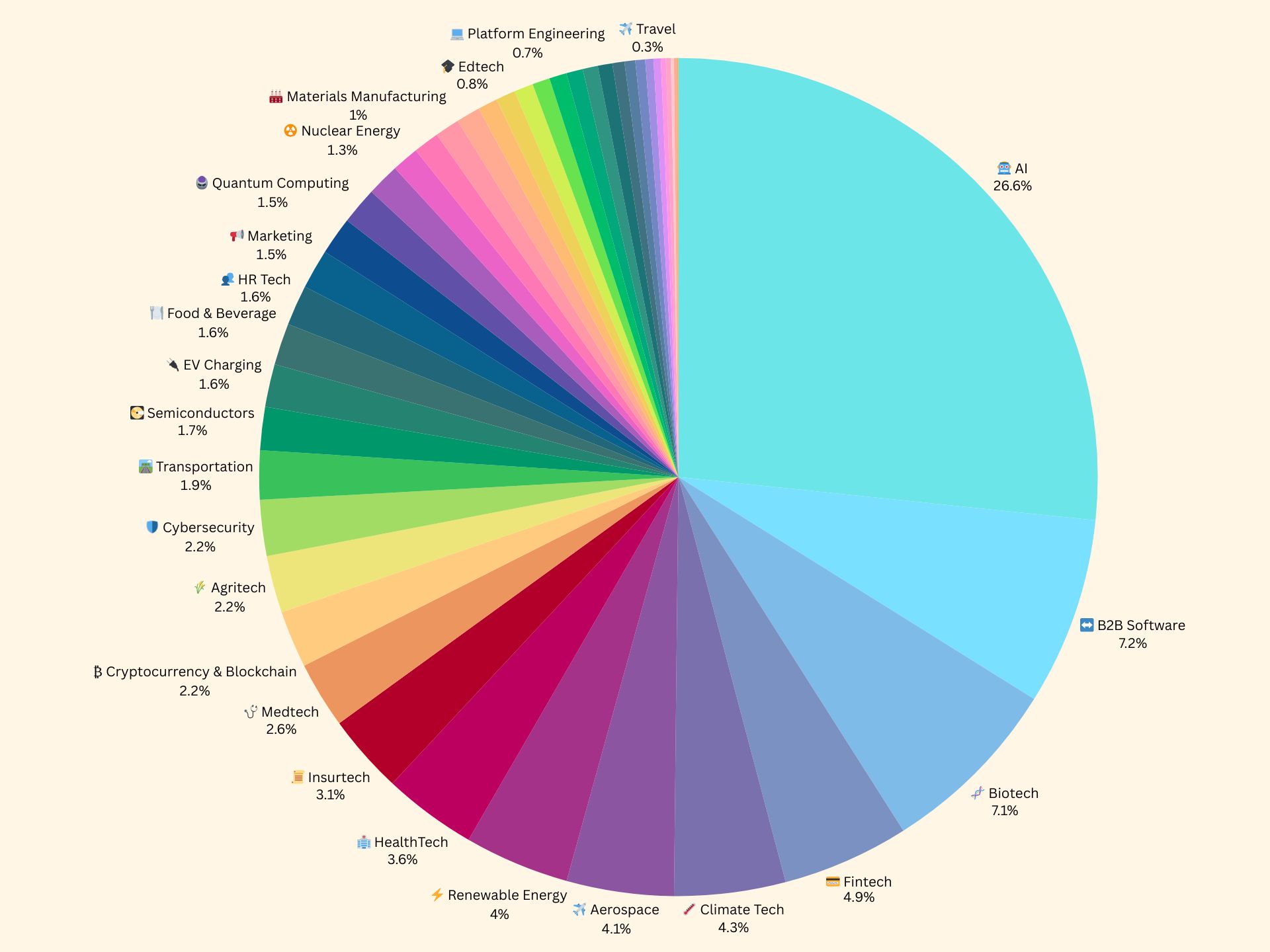

No surprises here, on an industry-by-industry level, AI raced to the top with over €2 billion in funding across 31 deals, vacuuming up 26% of all deal value.

However, without Mistral in the mix, AI was surprisingly not the hottest industry for fundraising in 2025—coming in 3rd place behind B2B software and Biotech.

Source: French Tech Updates

Categorizing companies into industries is more art than science, and I’m sure many more of the 542 companies on this list would consider themselves to be in building in AI (even if just for fundraising purposes). To avoid “AI as a marketing ploy” distorting the data in this review, I only placed a company into the AI bucket if they were developing a “pure-play” AI business—like foundation models or vertical AI tools.

Source: French Tech Updates

Returning to the top 10 industries for the year, Biotech, Health, and Energy remained in the spotlight. Fintech funding also benefited from a resurgence in 2025, breaking back into the top 10 with €388.2 million raised across 29 deals.

Biotech and Climate Tech saw the most activity of any industries with 53 and 43 deals announced respectively each. Consumer Tech was another unexpected outlier with 19 deals announced in 2025 across a myriad of use-cases ranging from subscription sharing (Sharesub) and anime (Flagcat) to sneakers made from fruits and plants (MoEa).

While AI captured a lot of the news coverage in 2025, the French tech ecosystem is much more diverse and interesting beneath the headlines.

Source: French Tech Updates

🆕 A big year for VCs

French VCs did some serious fundraising of their own in 2025 with 24 funds raising €6.2 billion in new capital to deploy. Even better, the raises are across a range of fund sizes from €21 million for Polytechnique Ventures up to €1 billion for Cathay Innovation.

That variety also likely indicates a broad pool of LPs backing French VCs last year—a further vote of confidence in French tech.

Source: French Tech Updates

🗓️ Seasonality and the French “U-Curve”

Where did everyone go in August? Of all the summers since I started writing this newsletter, this one was by far the slowest for deal announcements.

While I’m sure some of the September rounds actually closed over the summer, August was dead quiet in France. Deal announcements also tended to cluster around the start and ends of the year and the end of the quarter, so take the month-to-month view with a grain of salt.

Viewed by quarter, we get a better picture of the seasonality and the French fundraising U-Curve. Mistral bent the curve this year, but overall funding followed the typical journey where Q1 is active, Q2 and Q3 are quiet, and Q4 gets busy again.

This curve is even more clear when looking at quarterly deal volume, which also dipped in Q2 and Q3.

🏅 Top 10 Deals of 2025

In 2025, French Tech Updates covered 542 deals across France. To see the complete list of all 542 companies you can check out this database.

Of those deals, the top 10 captured 38% of all funds raised, showing that the power law is alive and well here in France.

Only 3 companies outside of Paris broke into the top 10: Loft Orbital and Solveo Energies based in Toulouse and Adcytherix in Marseille.

#1 Mistral

💼 Industry: AI foundation models

💶 Amount Raised: €1.7B (Series C)

🔗 Website: mistral.ai

📍Location: France & USA

✏️ Description: Develops large-language models and AI infrastructure tools aimed at building Europe’s open-source alternative to U.S. AI giants like OpenAI and Anthropic.

#2 Brevo

💼 Industry: B2B software (CRM)

💶 Amount Raised: €500M (Growth)

🔗 Website: brevo.com

📍Location: Paris, France

✏️ Description: Customer relationship and marketing automation platform offering email, SMS, WhatsApp, and CRM tools for SMBs and mid-market companies.

#3 Loft Orbital

💼 Industry: Aerospace

💶 Amount Raised: €170M (Series C)

🔗 Website: loftorbital.com

📍Location: Toulouse, France & USA

✏️ Description: Space infrastructure company providing “satellites as a service,” enabling governments and enterprises to deploy and operate payloads in orbit without owning or managing satellite platforms.

#4 Descartes Underwriting

💼 Industry: Insuretech

💶 Amount Raised: €111M (Series B)

🔗 Website: descartesunderwriting.com

📍Location: Paris, France

✏️ Description: Climate and parametric insurance provider using data science and AI to underwrite risks related to extreme weather events for corporates, insurers, and public-sector clients.

#5 Adcytherix

💼 Industry: Biotech

💶 Amount Raised: €105M (Series A)

🔗 Website: adcytherix.com

📍Location: Marseille, France

✏️ Description: Biotechnology company developing next-generation antibody-drug conjugates (ADCs) for cancer treatment, targeting improved precision and reduced toxicity compared to existing therapies.

#6 Alice & Bob

💼 Industry: Quantum computing

💶 Amount Raised: €100M (Series B)

🔗 Website: alice-bob.com

📍Location: Paris, France

✏️ Description: Quantum computing company focused on fault-tolerant quantum machines using “cat qubits,” aiming to dramatically reduce error correction overhead and accelerate practical quantum computing.

#7 Waat

💼 Industry: EV charging

💶 Amount Raised: €100M (Series C)

🔗 Website: waat.fr

📍Location: Paris, France

✏️ Description: Operates one of France’s fastest-growing public EV-charging networks, focused on rapid-charge infrastructure for cities, highways, and fleet operators.

#8 Solveo Energies

💼 Industry: Renewable energy

💶 Amount Raised: €98M (Growth)

🔗 Website: solveo-energies.com

📍Location: Toulouse, France

✏️ Description: Independent renewable energy producer specializing in wind and solar projects, with a strong footprint in France’s regional energy transition and grid-scale power generation.

#9 Genesis AI

💼 Industry: AI

💶 Amount Raised: €89M (Seed)

🔗 Website: genesis-ai.company

📍Location: Paris, France & USA

✏️ Description: Building foundational AI models and infrastructure and positioning itself as a next-generation European contender in large-scale AI systems.

#10 Pennylane

💼 Industry: Fintech

💶 Amount Raised: €75M (Series D)

🔗 Website: pennylane.com

📍Location: Paris, France

✏️ Description: Accounting and financial management platform designed for SMEs and accountants, combining real-time bookkeeping, banking, and reporting into a single integrated product.

If you enjoyed this post and want to help French Tech Updates grow I would greatly appreciate if you could share it with one person who may find it interesting.

Until next week ✌️ – James