- French Tech Updates

- Posts

- 🇫🇷 Q3, 2025 French Tech Funding Recap

🇫🇷 Q3, 2025 French Tech Funding Recap

🗞️ All the news you need from Q1 in France including: 💶 The top 10 fundraising deals, 9️⃣ new venture funds, 👨🔬 research breakthroughs.

Welcome to a special edition of French Tech Updates! Normally, this newsletter is your weekly source of startup, VC, and tech news and insights written by me, James— startup-obsessed American living in Paris. In this special edition, we’re taking a closer look at all the fundraising news from Q3, 2025.

🪞Q3, 2025 in the rearview mirror

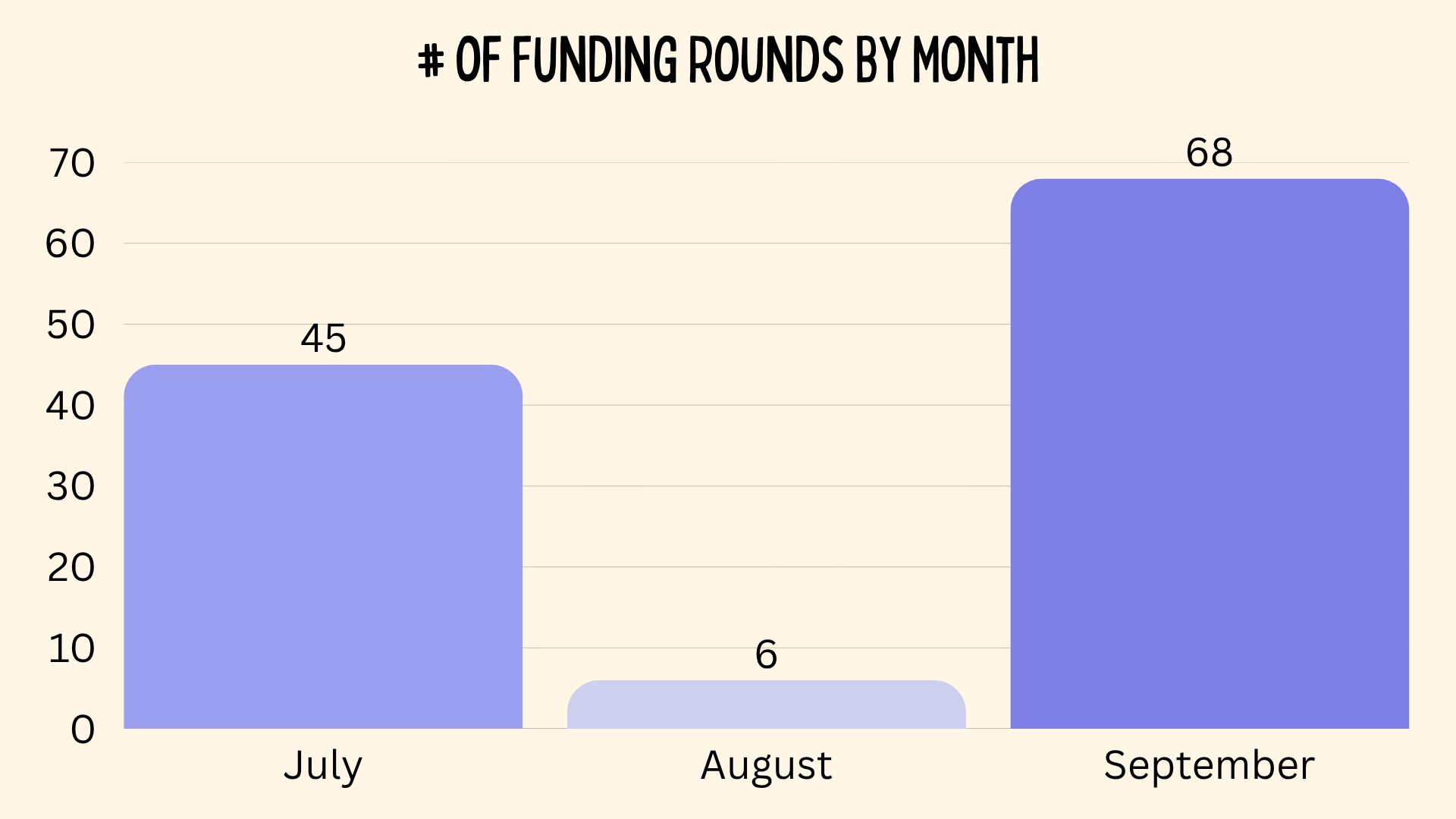

European summer wasn’t as quiet this year as deals started in August came to light in September.

In some ways, Q3 followed the classic “U” shaped path where funding is high in July, dips in August ,and roars back in September. One striking difference this year is that September totally dwarfs the other months all thanks to one deal (I’ll let you guess which one).

This report recaps all the major stories, fundraises, and data points from the quarter. I hope you enjoy it!

Table of Contents

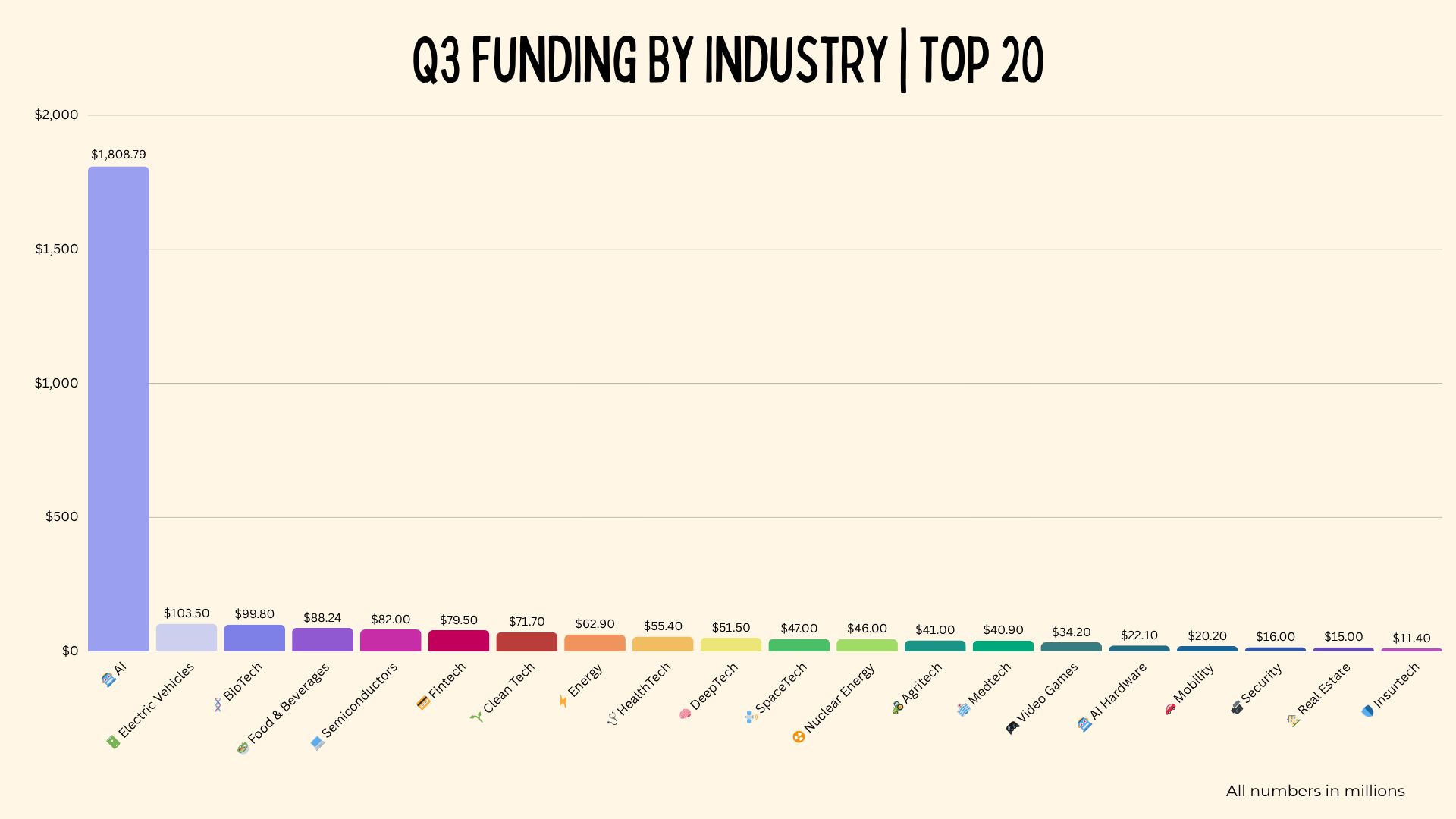

Guess which single deal pushed AI funding past €1B for the quarter?

Last year, I noticed an interesting trend. While early-stage funding was slowing down, overall funding totals masked that reduction thanks to a higher concentration of capital going towards mega-rounds of €100M or more. On an annualised chart, the funding concentration started to look top-heavy with more capital going to the biggest deals.

The last month of Q3 this year took this trend to another level with Mistral’s enormous €1.7B fundraise in September. Compared to the €2.88B total for the quarter, Mistral raised €500 more than every other French company combined during those three months.

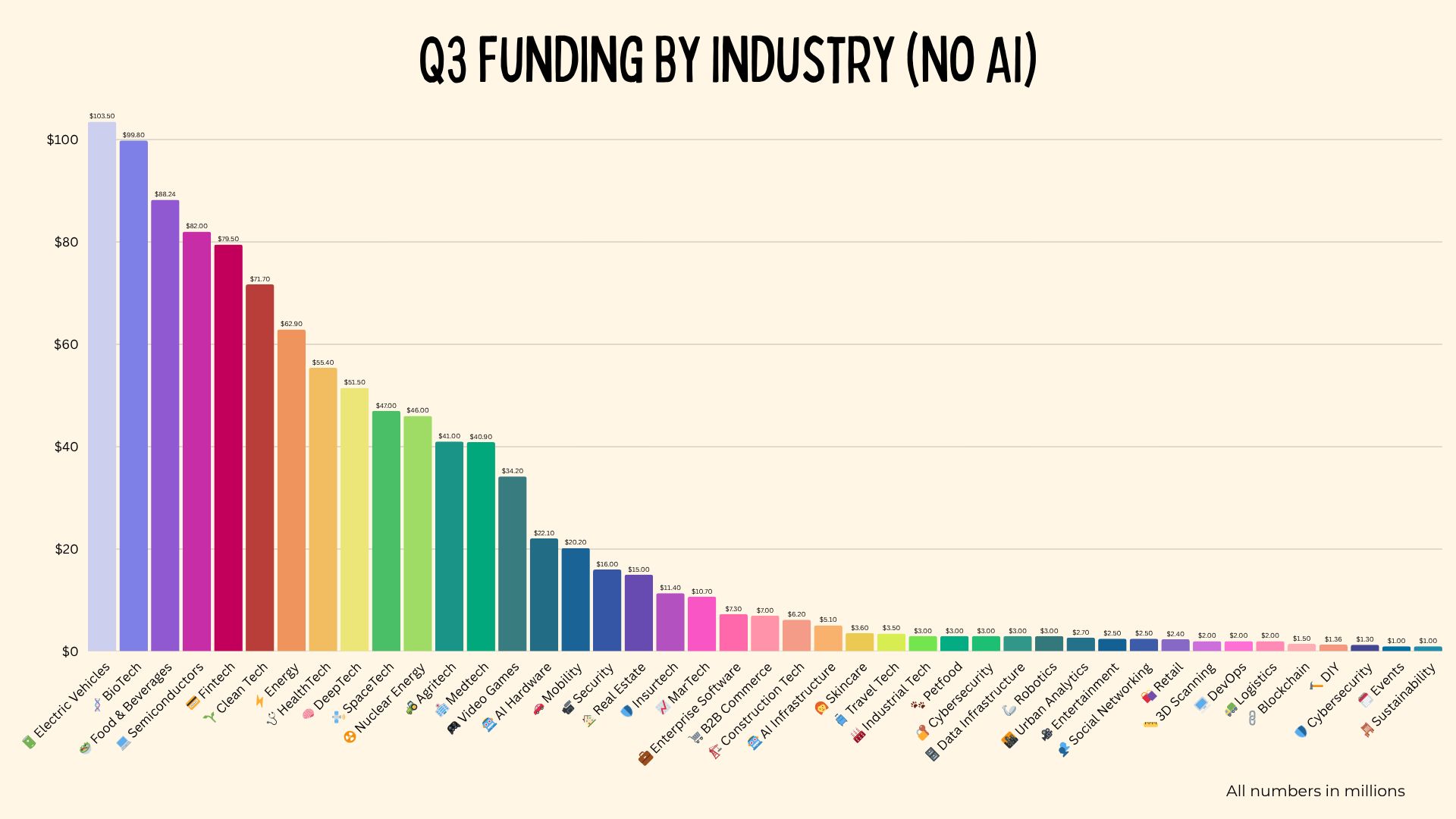

In fact, the Mistral deal skewed the y-axis on the Q3 chart so much that I’ve made a second version of this graphic with AI removed just so you can actually see the long-tail of the data.

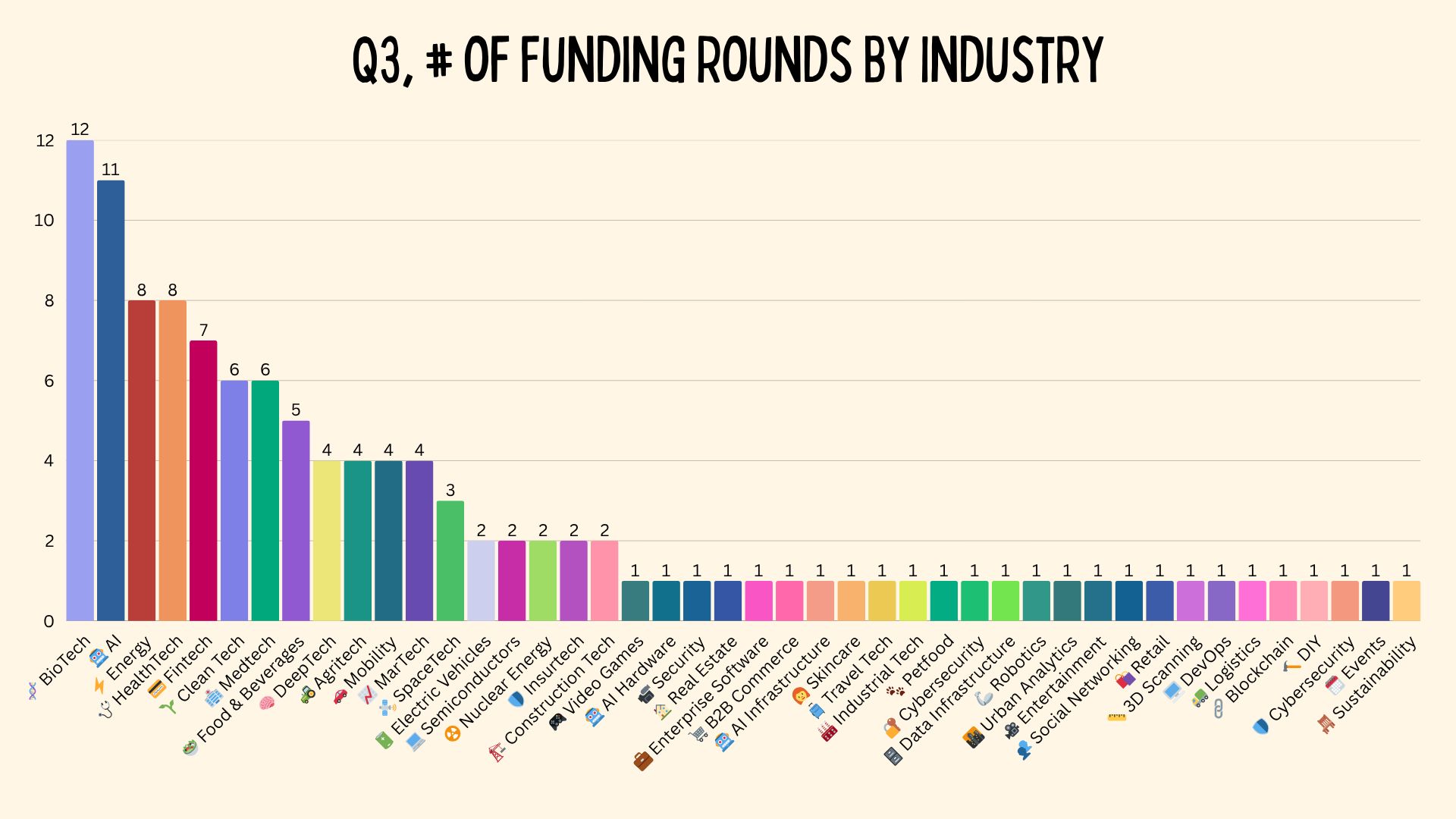

Comparing industry funding totals quarter-to-quarter can be misleading since individual large deals can send an industry skyrocketing up the rankings. For more on that, check out the # of rounds by industry chart below. Semiconductors, for example, is in the top 5 industries for total funding with only 2 deals last quarter.

When looking at total funding and total # of rounds compared to earlier this year, biotech funding remains a focus in France alongside energy and clean tech.

📊 Key Figures

💶 €2.88B in total funding📈 €3.1B announced for VC funds | 🗞️ 119 deals announced🦄 59% of all funds went to 1 deal |

🗓️ July €481.61M Raised 45 deals | 🗓️ August €32.39M Raised 6 deals | 🗓️ September €2,365.79M Raised 68 |

🆕 Venture Capital Stocked Up On Capital

French VCs raised much-needed funding in Q3 totalling €3.1B across more than a dozen unique funds, a major step up from H1, 2025. Included in the funding were several growth vehicles, which will help bridge (but not close) the major gap in European late-stage funding.

Eurazeo closed €650M of its €1B growth fund, marking a comeback after internal departures in 2023. The firm’s focus is shifting toward later-stage European AI startups where it sees execution, not product risk, as the biggest differentiator.

Sanofi Ventures reloaded €625M for its corporate VC arm, bringing total firepower to €1.4B to invest in biotech and digital health.

Quadrille Capital raised €500M across its Growth, Primary, and Secondary funds, expanding its crossover strategy between late-stage private and pre-IPO tech companies in Europe and the U.S.

Supernova Invest added €300M to fuel late-stage deeptech startups, a segment still underserved in Europe.

Serena announced a €200M early-stage fund focused on AI and the energy transition — two of France’s most active sectors this year.

Ventech closed its sixth fund at €175M, its largest yet, with half earmarked for vertical AI and the rest for digital health and industrial software.

C4 Ventures launched a €100M fund led by Pascal Cagni, with bets on semiconductors, quantum computing, and enterprise AI.

Otium Capital launched Otium Studio, a €180M startup studio aiming to build 10 companies per year through 2030. The firm will prioritize low-R&D, fast-to-market ventures in consumer and service sectors in a play to industrialize French company creation.

Omnes raised €112M for its second Real Tech fund, targeting €200M to back growth-stage deeptech companies in energy, industry, and space. The new vehicle doubles down on industrial innovation at a time when most capital is chasing AI

🤖 AI, AI, AI

From tension in Brussels to the blockbuster acquisition that never was, this summer had no shortage of AI stories in France. Here are the biggest ones.

Mistral joined more than 45 European firms calling for a two-year delay of the EU AI Act, arguing that the legislation is vague, premature, and risks crippling innovation. The open letter intensified Brussels’ tug-of-war between regulation and competitiveness.

Apple was briefly rumored to be in acquisition talks with Mistral while simultaneously exploring a purchase of Perplexity AI. Either deal would have marked Apple’s most aggressive AI move yet. How far those talks went is unknown, but the topic was discussed internally at Apple before fizzling out.

OpenAI shocked the industry by open-sourcing a new model on Hugging Face, a move CEO Sam Altman framed as “reconnecting” with the open-source community. For French players like Mistral, it signaled both validation of the open-source approach and a new channel of competition.

Meta refused to sign the EU’s voluntary AI “Code of Practice”, standing alone among major U.S. companies. The snub highlighted Meta’s willingness to risk bad optics to protect its data-hungry business model.

Meta and Hugging Face renewed their Station F accelerator, adding SNCF Connect as a partner to back five new AI startups.

Synapse Medicine launched “MedGPT,” which they claim outperforms ChatGPT on medical-knowledge exams. Early pilots with French hospitals suggest a credible path for clinical-grade AI assistance.

Cohere opened its European HQ in Paris after a $100M extension round. The Toronto-based enterprise AI company opened roles for 40 people in Paris with plans to double within a year.

🧱 Strategic Shifts, M&A & Corporate Plays

From mergers to new markets, Q3 was full of companies redrawing their boundaries.

LumApps acquired Swiss startup Beekeeper, merging its enterprise communication suite with Beekeeper’s mobile-first platform for frontline workers. The combined company, now valued north of $1B, creates a rare cross-border European SaaS leader with 7M users.

Doctrine acquired Predictice, its long-time French legaltech rival, creating a single AI-driven research platform with 25,000 European clients. The move ends years of parallel competition and positions Doctrine to expand into Germany and Italy.

Finary acquired Afluent—a personal wealth platform for high-earning tech employees founded by ex-Qonto staff. The deal, Finary’s first, came just weeks after its €25M Series B and could hint at plans to target financial advisors and employers through Afluent’s B2B tools.

Revolut hired Frédéric Oudea, the former Société Générale CEO, to join its board and guide European banking expansion. The move strengthens Revolut’s credibility as it eyes a full banking license and seeks to distance itself from regulatory controversies.

Back Market announced plans for a temporary New York pop-up store and 500 French retail points in an expansion from online sales and into physical repair and trade-in services for the refurbished device marketplace.

OpenClassrooms became the first French edtech accredited to issue U.S. diplomas, granting degrees in five states. This stamp of approval gives it a unique foothold in the U.S. job-market pipeline for a European entrant by pairing low-cost online education with accredited credentials.

BNP Paribas joined the “Je choisis la French Tech” initiative and committed to put procurement budgets towards French startups in a tangible show of corporate alignment with France’s broader tech-sovereignty push.

⚖️ Policy, Regulation & Politics

Budget battles, Big Tech drama, and yet another French government reset.

France unveiled a €43B budget plan to reduce its deficit to 4.6 % of GDP by 2026. Alongside cost cuts, the proposal would add €900M in startup equity funding, trim subsidies, and introduce a new “solidarity contribution” tax on top earners.

A government reshuffle under PM Sébastien Lecornu2 created uncertainty around startup policy as French Tech Mission head Clara Chappaz was replaced not once, but twice.

Economist Gabriel Zucman’s proposed 2 % wealth tax ignited a public backlash from founders and investors at FD Day. Mistral CEO Arthur Mensch said he “couldn’t afford it,” while Bpifrance chief Nicolas Dufourcq called the idea “absurd.”

Meta and Apple filed appeals against their combined €700M fines under the Digital Markets Act, contesting how Europe defines “gatekeepers.”

Elon Musk’s X refused to hand over data in a French investigation into algorithmic manipulation, calling it “politically motivated.”

The EU formally barred U.S. Big Tech firms, including Apple, Google, and Meta, from participating in its new FiDA financial-data system, handing European fintechs a rare competitive edge.

President Macron warned the U.S. that France and the EU will retaliate if Trump re-imposes digital-service tariffs, doubling down on Europe’s digital-sovereignty stance (spoiler alert, France struck back with a 5X tax increase in October).

BPCE issued Europe’s first €750M “Defense Bond,” earmarked for continental defense and security startups. The bonds represent one of the clearest financial links yet between the war-time economy and innovation policy.

⚗️ Science, Deeptech & Space Milestones

From quantum computing to defense, Q3 saw French companies making progress on a variety of fronts.

Alice & Bob unveiled a new method for generating “magic states” that could cut qubit requirements eightfold—a major step toward practical, fault-tolerant quantum computing.

CorWave completed the first successful human implantation of its cardiac assist pump, a milestone in its ongoing safety trials. The breakthrough could open a path to commercial approval by 2026.

Infinite Orbits signed a €50M contract with the French Ministry of Defense to provide in-orbit surveillance and servicing capabilities. The contract is the latest evidence of how space startups are becoming key defense assets.

Abivax raised $747M via is U.S. listing following 580% share growth after strong Phase 3 results for its ulcerative colitis drug. The raise gave Abivax the capital to launch its therapy in the U.S. market and scale manufacturing.

Harmattan AI reportedly began raising in next round at a €1B+ valuation less than 18 months after the company’s founding. The drone-defense startup’s “next-generation defense prime” ambitions underscore how fast Europe’s dual-use tech scene is maturing.

⚡ Corporate & Economic Pulse

The economic atmosphere in France looks similar to most developed economies in 2025. The mixed headlines have some corporations pulling back on staffing while others race ahead on the AI wave.

France’s GDP growth remained stable despite government turmoil and maintained a steady 0.3% increase—the same as in Q2.

Microsoft cut 10 % of its French staff (~200 roles) as part of a global restructure and reduction in staff, even as the company’s market cap surpassed $4 trillion.

Ÿnsect raised €8.6M in emergency funding while pausing operations and laying off half its workforce. The insect-protein pioneer now faces a court-supervised turnaround.

Two Verkor founders exited the company raising questions over leadership stability at France’s most heavily funded battery startup.

Late-payment risk ticked up again, with average B2B delays climbing to 14.1 days versus 13.5 last year, according to Altares.

🏅 Top 10 Deals of Q3

Mistral

💶 Amount Raised: €1.7B (Series C)

🔗 Website: mistral.ai

📍Location: France & USA

✏️ Description: Develops large-language models and AI infrastructure tools aimed at building Europe’s open-source alternative to U.S. AI giants like OpenAI and Anthropic.

Waat

💶 Amount Raised: €100M (Series C)

🔗 Website: waat.fr

📍Location: Paris, France

✏️ Description: Operates one of France’s fastest-growing public EV-charging networks, focused on rapid-charge infrastructure for cities, highways, and fleet operators.

Genesis AI

💶 Amount Raised: €90M (Seed)

🔗 Website: genesis-ai.company

📍Location: France & USA

✏️ Description: Builds foundational AI models and infrastructure in France and the U.S., positioning itself as a next-generation European contender in large-scale AI systems.

Scintil Photonics

💶 Amount Raised: €50M (Series B)

🔗 Website: scintil-photonics.com

📍Location: Grenoble, France

✏️ Description: Designs and manufactures silicon-photonics chips that combine lasers and electronics on a single wafer for faster, more efficient data transmission.

Nxtfood (Accro)

💶 Amount Raised: €49M (Series B)

🔗 Website: accro.fr

📍Location: Vitry-en-Artois, France

✏️ Description: Produces plant-based meat alternatives under the “Accro” brand, aiming to scale sustainable protein production in France and across Europe.

Lithium De France

💶 Amount Raised: €40M (Series B2)

🔗 Website: lithiumdefrance.com

📍Location: Haguenau, France

✏️ Description: Develops geothermal-based lithium extraction projects to supply Europe with locally sourced, low-carbon lithium for EV batteries.

Genomines

💶 Amount Raised: €38M (Series A)

🔗 Website: genomines.com

📍Location: Paris, France

✏️ Description: Uses plants and biotechnology to extract critical metals from soil through a sustainable “phytomining” process that replaces traditional mining.

Million Victories

💶 Amount Raised: €34.2M (PE Round)

🔗 Website: millionvictories.com

📍Location: Lyon, France

✏️ Description: Creator of the massively multiplayer online strategy game Million Lords, focused on large-scale, persistent mobile worlds built in France.

BrainEver

💶 Amount Raised: €33M (Series B)

🔗 Website: brainever.fr

📍Location: Paris, France

✏️ Description: A biotechnology company developing neurotrophic-factor therapies to regenerate neurons and treat neurodegenerative diseases such as Parkinson’s.

SiPearl

💶 Amount Raised: €32 (3rd tranche of Series A totalling €130M)

🔗 Website: sipearl.com

📍Location: Paris, France

✏️ Description: Builds high-performance microprocessors designed for Europe’s next generation of supercomputers and sovereign computing infrastructure.