- French Tech Updates

- Posts

- 🇫🇷 French Tech Updates — October 6, 2025. €131.7M in new funding for French companies.

🇫🇷 French Tech Updates — October 6, 2025. €131.7M in new funding for French companies.

What you need to know this week in France: 💰 €500M in new VC funds, ✈️ Entrepreneurs First exits the continent for San Francisco, 🇺🇸 Dataiku prepares for US IPO.

Welcome to French Tech Updates! Your weekly source of startup, VC, and tech news and insights. I’m James, a startup-obsessed American living in Paris.

A new theory of AI 🤖

I have a theory of fintech that any company in this space either dies young or lives long enough to launch a credit offering. Whether through direct financing, working capital loans or selling margin trading access for a monthly fee à la Robinhood, credit products are like a black hole that all product roadmaps eventually gravitate towards. Probably not without reason since this is the primary way banks have been making money for centuries.

Lately, I see a new version of this maxim developing in AI: die young or live long enough to launch an infrastructure play.

French AI superstar Mistral has already lived long enough to start down this path with the launch of Mistral Compute in June of this year. Thanks to a partnership with Nvidia likely worth > €1B, Mistral plans to offer “private, integrated stacks of GPUs, orchestration, APIs, products, and services in whatever form factor they need, from bare-metal servers to fully-managed PaaS.”

The move into AI infra is certainly a differentiator for Europe’s last-standing (for now) LLM player.

…except not really because OpenAI is also doubling down on infra plays in the US at a ridiculous scale, even if those investments remain internal for now.

Just last month, Nvidia announced a gargantuan $100 billion collaboration with OpenAI to deploy 10 gigawatts of AI data centers using Nvidia’s systems—which sparked an update to the “infinite money glitch” meme that has been making the rounds lately.

While not (yet) compute as a service, OpenAI has already teased their interest in this space with their invite-only OpenAI Foundry developer platform launched in 2023. Whether OpenAI continues to use their infrastructure for themselves or starts renting it out to customers, it’s clear that these investments are seen as a critical focus for the company.

In his recently restarted personal blog, Sam Altman had this to say on the topic:

“Over the next couple of months, we’ll be talking about some of our plans and the partners we are working with to make this a reality. Later this year, we’ll talk about how we are financing it; given how increasing compute is the literal key to increasing revenue, we have some interesting new ideas. “

If fintechs inevitably become banks then AI companies inevitably become data centers, except in this race the balance sheets are measured in gigawatts instead of deposits.

With that, let’s jump into this week’s update!

What’s new this week in 🇫🇷

💰 Supernova Invest raises new €300M late-stage fund: the deep-tech focused vehicle will write tickets up to €15M.

🪖 French drone maker Harmattan AI prepares to raise at €1B+ valuation: the autonomous attack drone creator, which describes itself as “a next-generation defense prime,” was founded just last year and employs ≈50 people.

🤑 Serena raises new €200M early-stage fund: The fund will be dedicated to AI and the energy transition and brings the total new funds announced by French VCs in the last 30 days to over €1.4 billion.

🤝 Wealth management platform Finary acquires Afluent: The deal, which closed for an unknown amount, took place a little under 3 years after several former Qonto employees left to start Afluent—a wealth management platform for tech workers.

🇺🇸 Dataiku prepares for US IPO: The Franco-American AI company, founded in Paris in 2013, is reportedly on track for a public listing as soon as Q1, 2026.

👾 Mathieu Tarnus debuts 404 Ventures: The new seed fund belonging to the founder of the digital services group Positive will professionalize his already active angel investing role, which has seen him back more than 40 startups.

👋 Entrepreneurs First says goodbye to the EU: The London-based accelerator, frequently abbreviated as EF and known for its “talent-first” model, is ending its programs in France and Germany to concentrate its focus on the U.S. and San Francisco.

🌍 Headlines from around the world

⚖️ Frank founder Charlie Javice sentenced to 7 years in prison for defrauding JPMorgan Chase (Fortune)

🧠 DeepSeek unveils ‘Sparse Attention,’ a next-gen AI model for faster, cheaper long-context processing (Tech Startups)

💰 Former Sequoia Capital partner Matt Miller raised over $400M for his new London-based B2B AI fund: Evantic Capital. 3/5 investments made so far have been in European companies, including Lovable and n8n (Matt Miller)

📈 Revolut weighs $75 billion dual listing in New York and London (The Times)

👨👩👧👦 OpenAI adds parental controls to ChatGPT (TechCrunch)

🎧 Daniel Ek steps down as Spotify CEO after 19 years (Pitchfork)

🧿 California's passes the US’ first major AI safety law: SB 53 (TechCrunch)

🎥 OpenAI is making a video-first social media app with 100% AI-generated content (Gizmodo)

💻 Claude released Sonnet 4.5 with impressively expanded coding abilities (Simon Willison)

🛍️ You can now buy products in ChatGPT (OpenAI)

🇨🇳 China rushes to poach young tech talents with the K visa program (Neowin)

🏢 OpenAI became the most valuable private company in the world at $500B valuation (CNBC)

🇬🇧 Concept II launches as Europe’s largest pre-seed VC fund with $88 million (Concept Ventures)

New Funding 💶

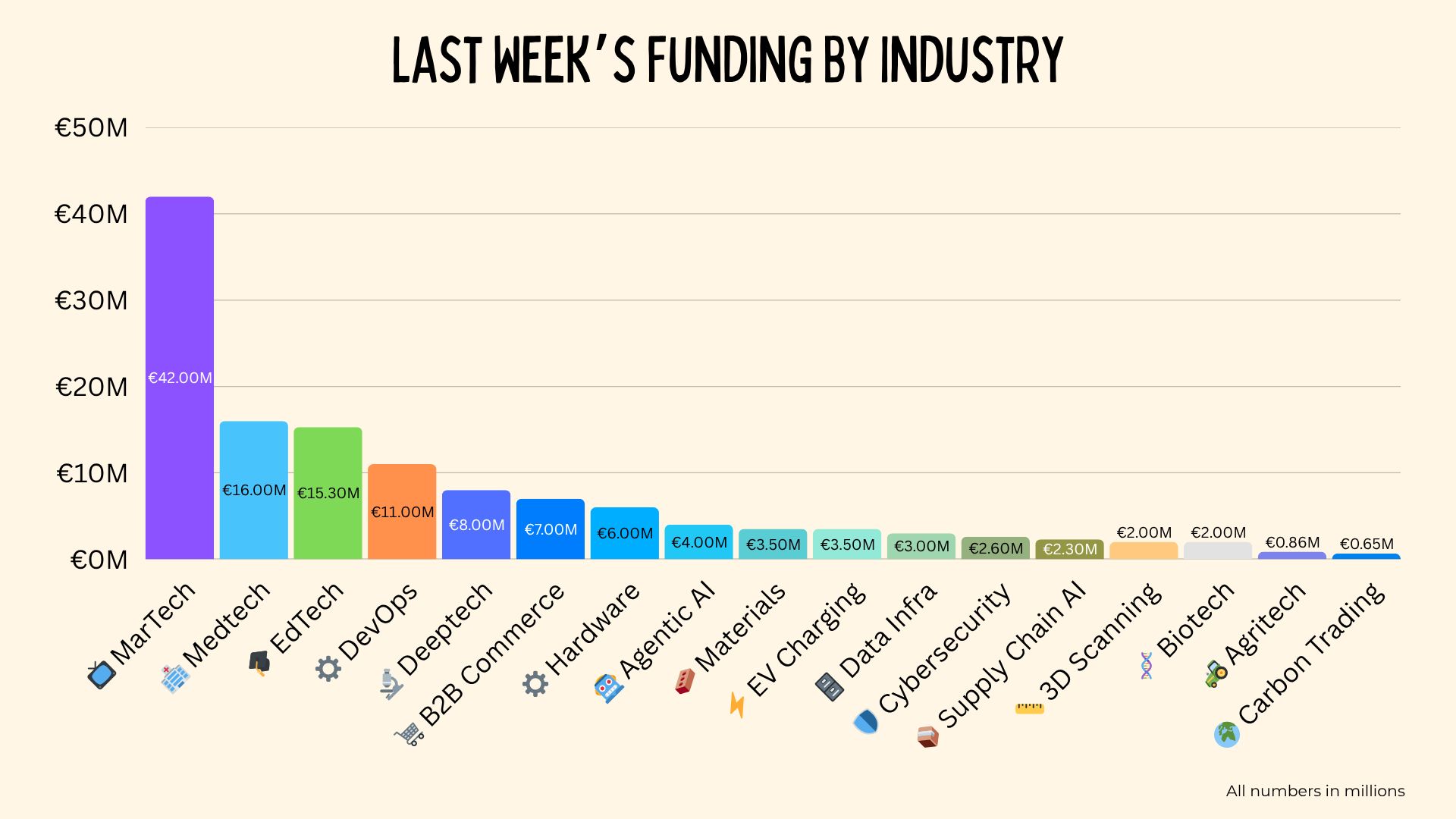

18 companies announced €131.71M in new funding last week including a €650K Seed round by Initiativ (Carbon Allowance Trading) €860K extension for Kapsera (Agritech) and an unknown amount by Avanoo (SaaS).

MyFit Solutions | €2M | 📏 3D Scanning

Lyon-based MyFit Solutions raised €2 million from Acer Finance, Provence Angels, Key Ventures, and Bpifrance. The startup develops smartphone-based 3D body scanning for orthopedics, medicine, and retail. The funding will expand R&D, partnerships, and international rollout of its digital measurement platform.

SeaBeLife | €2M | 🧬 Biotech

Roscoff-based SeaBeLife raised €2 million in a pre-Series A round led by iXLife with Breizh Angels, Angels Santé, INEXT, and Femmes Business Angels. The startup is developing first-in-class drugs that block two regulated cell death pathways to treat dry age-related macular degeneration (AMD) and severe acute hepatitis. The new funding supports clinical trial preparation, with the first trial slated for 2026.

Metreecs | €2.3M | 📦 Supply Chain AI

Paris and San Francisco-based Metreecs raised €2.3 million ($2.7 million) from Monte Carlo Capital, Founders Future, Kima Ventures, Bpifrance, and Y Combinator. The startup uses AI and digital twins to help retailers cut overstocks and shortages by simulating logistics networks with external data like weather and online trends. Early customers report up to 80% fewer stockouts. The new funding supports R&D and expansion in Italy and the U.S.

MokN | €2.6M | 🛡️ Cybersecurity

Paris-based MokN raised €2.6M in a seed round led by Moonfire with OVNI Capital, Kima Ventures, and angels. The startup’s “phish-back” tech plants realistic decoy VPNs and email servers that trick hackers into using stolen credentials—letting security teams intercept and neutralize them before damage occurs. The funding will support U.S. expansion and new detection features.

Popsink | €3M | 🗄️ Data Infra

Paris-based Popsink raised €3M in a seed round led by IRIS with XAnge, Seedcamp, and angels to modernize enterprise data flows. Its Change Data Capture (CDC) tech pulls updates in real time from legacy systems like ERPs and mainframes into platforms such as Snowflake and Databricks—helping companies unlock AI and analytics without costly migrations.

Synboli | €3.5M | 🧱 Materials

Bordeaux-based Synboli raised €3.5M in seed funding led by Aquiti and Wind to accelerate its AI-driven platform for designing sustainable polymers. By combining AI with synthetic chemistry, the startup aims to create biodegradable, non-toxic materials for use in health, cosmetics, agriculture, construction, and electronics.

UP&CHARGE | €3.5M | ⚡ EV Charging

Île-de-France-based UP&CHARGE raised €3.5 million, including €3 million via Tudigo crowdfunding, to industrialize its wireless charging tech for electric vehicles. Drivers simply park to start charging, no cables required. The French-made system is faster than wired options, cheaper to install, and already attracting pre-orders from fleets of up to 70,000 vehicles.

Clarifeye | €4M | 🤖 Agentic AI

Paris-based Clarifeye raised €4M in a pre-seed round led by EQT Ventures to build AI agents that replicate expert reasoning in fields like law, life sciences, and manufacturing. The platform captures and encodes human expertise into GenAI workflows, helping organizations scale scarce specialist knowledge into reliable, domain-specific AI systems.

Plasana Medical | €4M | 🏥 Medtech

Paris-based Plasana Medical raised €4M in equity and non-dilutive funding to advance Plasana One, a cold plasma device that speeds up chronic wound healing by 30–50% while reducing infection risk. The funding will support clinical trials in Europe, CE marking by 2026, and preparations for U.S. market entry.

iNGage | €6M | ⚙️ Hardware

Grenoble-based iNGage raised €6M in its first funding round. The startup builds ultra-precise navigation sensors that keep self-driving cars, drones, and robots on track when GPS fails (like in tunnels or cities with poor signals). Backed by Supernova Invest and 360 Capital, iNGage will use the funds to bring its chip-sized sensors to market, offering defense, automotive, and industrial players a cheaper and more compact alternative to bulky aerospace systems.

DJUST | €7M | 🛒 B2B Commerce

Paris-based DJUST raised €7M in a Series A extension led by NEA with support from Elaia and Speedinvest. The startup runs a modular B2B commerce platform already processing €1.5B in annual transactions, and will use the funds to expand across Europe while launching AI-powered sales agents and DJUST Pay, a B2B payments module.

TiHive | €8M | 🔬 Deeptech

TiHive raised €8M in a round led by Karista, Wind, and the EIC Fund. The Grenoble-based deeptech startup builds industrial inspection systems using proprietary terahertz-on-silicon chips and AI to spot invisible defects directly on production lines. Already adopted by leading hygiene manufacturers, TiHive will use the funds to expand globally and advance next-gen terahertz chips for broader applications in textiles, recycling, agriculture, and aerospace.

Qovery | €11M | 💻 DevOps

Paris-based Qovery raised €11.3M in a Series A round led by IRIS to expand its DevOps automation platform that simplifies cloud deployments across AWS, GCP, Azure, and on-prem Kubernetes. Already growing 115% YoY with half of its revenue from the U.S., Qovery will use the funds to push deeper into the U.S. market, grow its team, and advance AI-driven product features.

RDS | €14M | 🏥 Medtech

Strasbourg-based RDS raised €14M in a Series A round led by Bpifrance’s SPI fund to bring its MultiSense connected patch for remote patient monitoring to market. Already tested in 15 hospitals in France, Belgium, and Germany, the device tracks six vital signs and is designed for both hospital and at-home use. The funds will support manufacturing, European expansion, and preparation for a U.S. launch in 2028.

Edflex | €15.3M | 🎓 EdTech

Paris-based Edflex raised €15.3M ($18M) from Bpifrance Digital Venture, Educapital, Ternel, and Wille Finance to expand its AI-powered corporate learning platform. Profitable in core markets, the startup aggregates training content from 10,000+ publishers for 300+ clients.

Vibe.co | €42M | 📺 MarTech

Paris and New York-based Vibe.co raised €42M ($50 million) in a Series B round led by Hedosophia with participation from existing investors including Singular, Elaia, and Revolut CEO Nik Storonsky’s QuantumLight fund. The company’s AI-fueled connected TV ad platform enables performance marketers bring Instagram-style targeting to streaming. Already used by 5,000+ brands with a reported 250% ROAS, the startup hit a $100M revenue run rate in under two years and now plans to double down on AI-generated ad creative and U.S. expansion.

Upcoming Events 🗓

Vibe Coding Paris Meetup #1 w. Strapi & Hexa – October 6

[Webinar] Understanding Non-Dilutive Financing: Issues and Strategies for Your Startup – October 9

Exploring Cybersecurity in Web3 with Ledger x 42Blockchain – October 10

Serena Run Club #10 - Run for Gender Diversity at work – October 13

MCP Connect with Alpic, Alan & Mistral – October 14

Levées de fonds pour les startups AI-natives : les conseils des VCs – October 14

Unlock VC Summit 2025 – October 14-15

Next Gen Female Founders – October 15

SISTAFUND x FUND F x AUXXO breakfast 🥐 – October 15

Paris Meetup: Automations for Freelancers and Solopreneurs – October 16

Devfest Nantes 2025 – October 16-17

Microbiology 2.0 – October 30

The European AI Championship 2025 Launch Party – November 5

Interesting Jobs 👩💻

What Else I’m Reading 📚

What does the internet look like in a post-search world? (Tech Brew)

This French VC went from posting on YouTube to raising a $12M fund for Y Combinator startups (TechCrunch)

Caltech Builds World’s Largest Neutral-Atom Quantum Computer (Decrypt)

Friend AI (which spend $1.8M on its domain name) failed to make friends (Pivot to AI)

AI-Generated “Workslop” Is Destroying Productivity (Harvard Business Review)

This is how the AI bubble will pop (Derek Thompson)

TechpressoWhy you’ll like it: Daily updates on the latest tech and AI news in an easy-to-read format. Stay in the know while finishing your morning coffee. | A Smart Bear: LongformWhy you’ll like it: Practical insights from building two unicorn companies, covering product, growth, prioritization, and much more. |