- French Tech Updates

- Posts

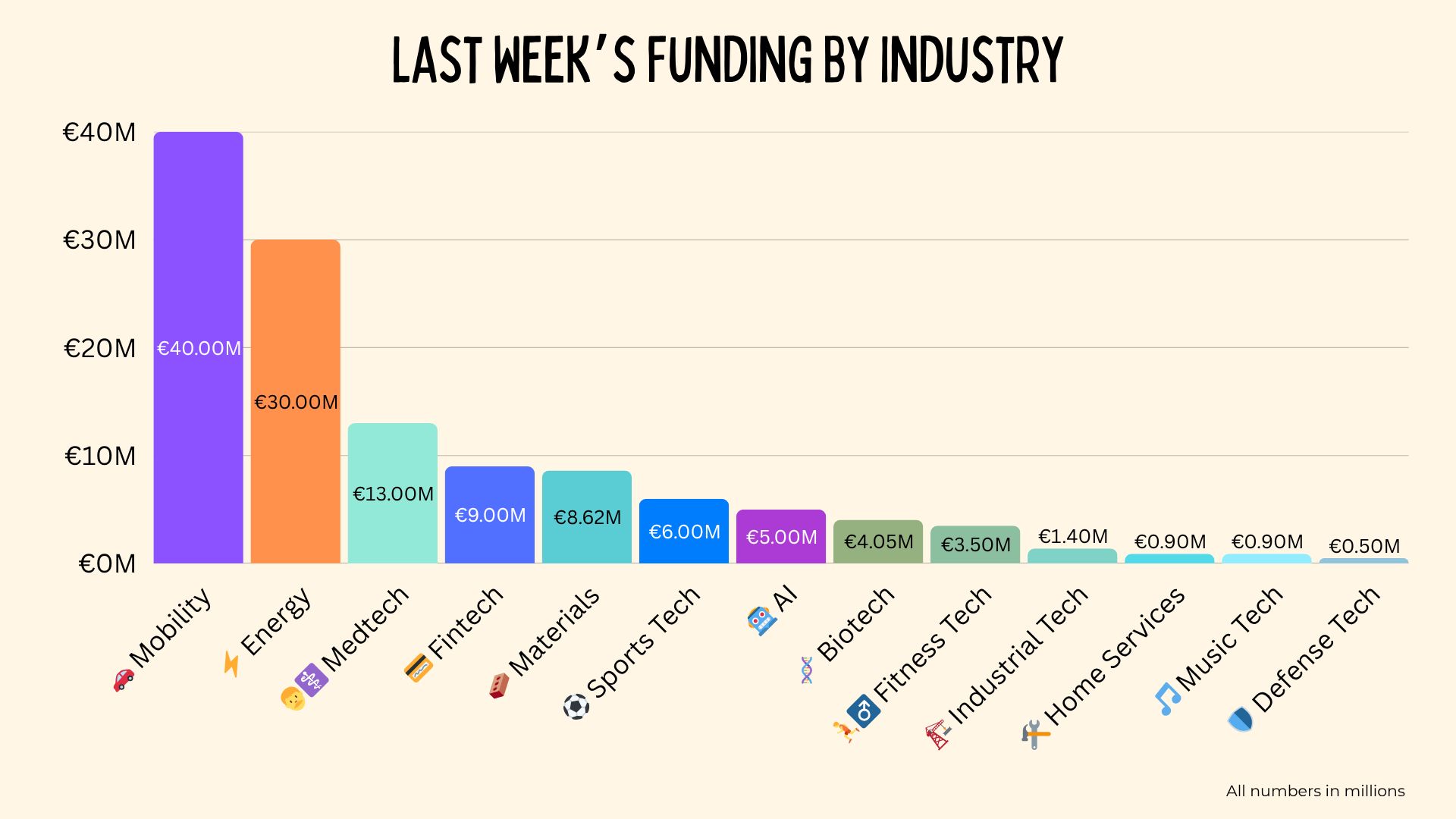

- 🇫🇷 French Tech Updates — November 3, 2025. €122.87M in new funding for French companies.

🇫🇷 French Tech Updates — November 3, 2025. €122.87M in new funding for French companies.

What you need to know this week in France: 🛫 Criteo to move HQ outside of France, 🇫🇷 French digital minister lays out priorities for French tech, 🚁 sovereign defense tech making moves.

Welcome to French Tech Updates! Your weekly source of startup, VC, and tech news and insights. I’m James, a startup-obsessed American living in Paris.

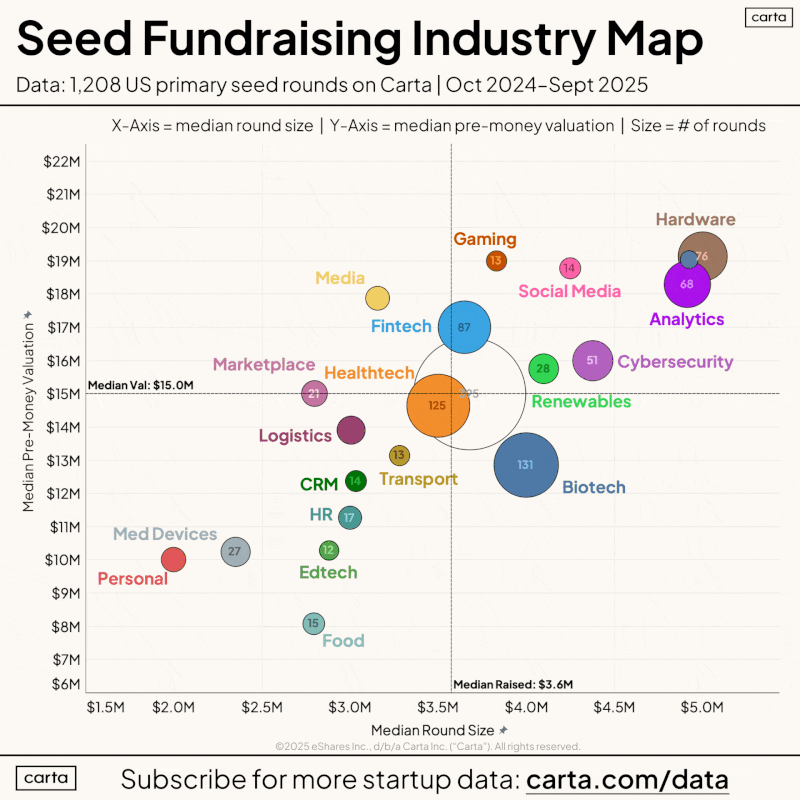

📝 Quiz: In the past year, the industry with the largest median seed round has been $5.2M. Which industry is it?

(answer at the bottom of the newsletter)

A.) 🤖 AI Applications

B.) 📱 Social Apps

C.) 🛡️ Cybersecurity

D.) 🔨 Hardware

What’s new this week in 🇫🇷

🇫🇷 France’s new digital minister discusses her priorities for France’s startups: In an interview with Maddyness three weeks into her new job, Anne Le Hénaff laid out her focus on digital sovereignty, helping startups scale while remaining in Europe, and the threats of overtaxation, overregulation, and political instability.

🛫 French ad tech Criteo is moving its HQ outside of France: The 20-year-old, publicly listed company was an early French tech success, but now intends to move its headquarters out of Paris—first to Luxembourg and then, likely, to the US.

🚁 Alta Ares’ anti-drone technology has been validated by NATO: The French defense tech, which also announced new funding in May of this year, has opened a new production facility in France to produce interceptor drones for their “tactical protection dome.” Drone defense has emerged as a critical need for modern battlefields as drone swarm attacks continue to cause chaos in the ongoing conflict between Ukraine and Russia.

🌍 Headlines from around the world

🤑 Nvidia becomes the world’s first $5 trillion market cap company (CNN)

🎥 AI video company Synthesia tops $4 billion valuation (Forbes)

👾 Discord prepares for IPO (Morningstar)

🥄 Milan-based Bending Spoons will acquire AOL in a $1.5 billion deal (TechCrunch)

🦾 OpenAI lays groundwork for juggernaut IPO at up to $1 trillion valuation (Reuters)

🔻 Navan stock falls 20% after $6 billion IPO (CNBC)

🪓 Amazon cuts 14,000 corporate staff with more likely to follow (GeekWire)

🦿 1X Technologies’ Neo humanoid robot is available at a $20K pre-order price (CNET)

🏦 Revolut is near completing a $3 billion raise at a $75 billion valuation, making it the world’s 8th most valuable private company (Bloomberg)

💸 Microsoft, Meta, and Google spent $80 billion on data centers last quarter (CoStar)

AI agents are getting a lobby group in DC (Semafor)

New Funding 💶

15 companies announced €122.87 million in new funding last week including €0.5M by Tibeka Protections (🛡️ Defense Tech) €0.9M by Kelkun (🛠️ Home Services), and €0.9M by MNGRS.AI (🎵 Music Tech).

Cellura | €1.2M | 🧬 Biotech

Marseille-based Cellura, formerly SoftCell Therapeutics, has raised €1.2 million in a seed round led by Seed for Good, with support from Angles Bay Invest, Bpifrance, and family offices. The startup develops bioreactors designed to cultivate fragile cells more efficiently, targeting industrial uses in health (like cell therapies) and agri-food (such as alternative proteins). Rather than becoming a manufacturer, Cellura aims to license its tech to industry partners. This funding sets the stage for industrial-scale validation, with licensing revenue expected to follow by 2026.

DotBlocks | €1.4M | 🏗️ Industrial Tech

Paris-based DotBlocks has raised €1.4 million in a pre-seed round from OPRTRS Club, Aglaé Ventures, and Kima Ventures to make industrial simulation software more accessible. Their platform allows engineers and non-experts to create and run digital simulations—like stress tests or performance models—much faster and with less friction. Built with Eliud Kipchoge-level intensity (minus the running), the system speeds up simulation cycles from six weeks to six days, aiming to bring high-performance modeling to the entire industrial value chain.

Primaa | €2M | 🩻 Medtech

Paris-based Primaa has extended its latest funding round from €5 million to €7 million, with backing from MH Innov’, Elaia, and SWEN Capital Partners. The startup builds AI tools for digital pathology, including Cleo Breast for breast cancer diagnostics and Cleo Skin, which it claims is the first tool able to diagnose multiple skin cancers from histology slides. The funding will support European growth, team expansion, and FDA certification efforts for a U.S. launch.

Exeliom Biosciences | €2.85M | 🧬 Biotech

Paris-based Exeliom Biosciences has raised €2.85 million in a Series A extension, bringing the total round to nearly €12 million. The clinical-stage biotech is developing EXL01, an immunomodulating therapy currently in Phase 2 trials for cancers, inflammatory bowel disease, and infections like C. difficile. The new funding, led by Biocodex, will support ongoing clinical studies and preparation for a new cancer indication in the U.S.

Kotcha | €3.5M | 🏃♂️ Fitness Tech

Kotcha, the running startup co-founded by marathon legend Eliud Kipchoge, has raised €3.5 million in pre-seed funding to bring AI-powered coaching to amateur runners. Backed by Racine2, True Global, and Motier Ventures, the app offers personalized training inspired by Kipchoge’s Kenyan training camp—complete with virtual coaches for fitness, nutrition, and performance analysis. It aims to fill the gap between generic running plans and pricey human coaches, with a global rollout in the works.

Volta Software | €5M | 🤖 AI

Volta, a French-Italian startup founded in 2024, has raised a €5 million extension led by RTP Global and joined by new investor Pascal Houillon. This latest close brings total funding for the round to €11 million. The company aims to modernize B2B commerce by automating manual workflows like order entry and pricing updates for suppliers and distributors. In the process, their tools will replace PDFs and spreadsheets with more flexible, integrated systems. The company claims to save 7+ hours per employee weekly and lift sales by 11%.

Playse | €6M | ⚽ Sports Tech

Paris-based Playse, founded by former PSG player Blaise Matuidi and Doctolib exec Thibault Aliadière, has raised €6 million to push into the U.S. market ahead of the 2026 World Cup. The sportech startup offers AI-driven video tools and online coaching for amateur football players. The round, combining venture capital, business angels, and crowdfunding, will also fund its merger with Move’n See, a company that makes auto-tracking cameras for match footage.

altrove | €8.62M | 🧱 Materials

Paris-based altrove has raised €8.62 million ($10 million) in a seed round led by Alven to scale up production of AI-designed materials that replace critical imports like rare earths and cobalt. The startup’s platform uses AI, automation, and self-learning systems to speed up material discovery for industrial uses from high-performance motors to sensors. With backing from Bpifrance, Contrarian Ventures, and Emblem, Altrove aims to help Europe secure more sustainable and sovereign supply chains.

FAKTUS | €9M | 💳 Fintech

Paris-based neobank FAKTUS has raised €9 million in equity and €47 million in debt to digitise financial services for construction SMEs. Founded in 2023, FAKTUS provides fast, tailored financing for worksites, using AI to process contracts and invoices in hours rather than weeks. Its platform covers everything from invoice financing to retention bonds, already supporting over €100 million in projects including hospitals, housing, and even Roland Garros. The startup aims to expand to six countries and fund €500 million in construction over the next 18 months.

Scap Hologram | €11M | 👩⚕️ Medtech

Grenoble-based SCAP Hologram, a medtech startup developing real-time navigation systems for shoulder surgery, has raised €11 million in equity and a further €11 million debt. Backers include Haventure, MinMaxMedical, eCential Robotics, and private investors from Surosh, along with support from Bpifrance. Founded in 2024, the company plans to launch its first surgical solutions by 2027.

Dracula Technologies | €30M | ⚡ Energy

Valence-based Dracula Technologies completed the final close of its €30 million Series A round to ramp up production of its battery-free IoT modules, which harvest energy from indoor light. The funding, backed by Banque des Territoires, MGI Group, and the EIC Fund, will quadruple production capacity and support international expansion. Their tech eliminates the need for batteries in connected devices—an appealing pitch for both sustainability and operational efficiency as the €10 billion battery replacement market grows.

Onepark | €40M | 🚗 Mobility

Paris-based Onepark, a digital platform for booking parking spots, raised €40 million in a round led by TotalEnergies, which also came on board as a partner. Existing investors Keolis, ADP, and Accor also participated. Onepark, now active in 10 European countries, manages over 3,500 parking facilities and claims 2.7 million users. The TotalEnergies deal could give Onepark access to 2.3 million Fleet cardholders, potentially doubling its revenue to €60 million and surpassing rival Yespark.

Upcoming Events 🗓

Derrière les coulisses d’un exit – November 4

The European AI Championship 2025 Launch Party – November 5

🆕 dotAI Closing Gala x Dust – November 6

🆕 Stride-up et WAX vous donnent rendez-vous chez Meta – November 6

Google AI Founders Studio – November 12-28

🆕 Neurons and Peppers #2 – November 12

Tectonic European Defense Summit – November 12-13

Paris Meetup | fal x Hugging Face x BFL – November 13

🆕 Paris AI Hackathon @StationF by Pioneers – November 15-16

Interesting Jobs 👩💻

What Else I’m Reading 📚

How OpenAI Uses Complex and Circular Deals to Fuel Its Multibillion-Dollar Rise (NYT)

As AI reshapes the job market, here are 16 roles it has created (The Washington Post)

Investors vs. the public: Who gets the AI returns? (Semafor)

TechpressoWhy you’ll like it: Daily updates on the latest tech and AI news in an easy-to-read format. Stay in the know while finishing your morning coffee. | A Smart Bear: LongformWhy you’ll like it: Practical insights from building two unicorn companies, covering product, growth, prioritization, and much more. |

Quiz Answer: D.) Hardware

According to data from Carta, hardware startups are raising the largest seed rounds at median pre-seed valuations of $19 million. Although AI applications average slightly smaller round sizes at $4.5 million, their valuations are the highest of the group at $20 million pre-money.

The full breakdown of the top-5 industries in the data set, which draws from 1,208 US-based startups is:

Hardware | $5.2M median raised at a $19M pre-money valuation

Analytics/Data | $4.8M median raised at a $18.5M pre-money valuation

AI applications | $4.5M median raised at a $20M pre-money valuation

Cybersecurity | $4.3M raised at a $16M pre-money valuation

Social Apps | $4.2M raised at a $18.8M pre-money valuation