- French Tech Updates

- Posts

- 🇫🇷 French Tech Updates — La Rentrée 2025 Special Edition

🇫🇷 French Tech Updates — La Rentrée 2025 Special Edition

What you need to know in France: 🤖 Will Mistral raise €1B or sell to Apple? 🤗 OpenAI goes open source on Hugging Face, 🌎 must-follow news from around the world.

Welcome to French Tech Updates! Your weekly source of startup, VC, and tech news and insights. I’m James, a startup-obsessed American living in Paris.

Welcome back 🥳

C’est la rentrée!

Whether you spent August chasing the sun at the beach or chasing deals while your colleagues were away I hope you enjoyed the relative peace and quiet of the summer.

As the (French) world returns to work, you may worry about what you missed while you were out. T'inquiete pas ! I’ve got you covered.

This special edition of French Tech Updates sums up the biggest news from the last 4 weeks into one, twenty minute read.

So pour yourself a fresh coffee, grab a comfy seat, and let’s dive in!

🇫🇷 Les Grandes Nouvelles en France

🤖 The summer of Mistral

Rumors are swirling that Apple is eying the French AI leader as a potential acquisition target alongside Perplexity. Such a deal would mark a major departure from Mistral’s status as the “final European hope” for a sovereign LLM that can compete with the likes of OpenAI and Anthropic. Simultaneously, Mistral is reportedly pursuing a €1B funding round at a €10B valuation, which would mark a 72% increase from their €5.8B valuation achieved during their Series B fundraising in June, 2024. T

This year has seen Mistral diversify from developing proprietary models to test the waters in infrastructure plays and defense partnerships—which to me says they’re experimenting to find their edge. The fresh funding route seems more likely than an acquisition, but even with €1B I see Mistral continuing to struggle in a head-to-head competition against over well-funded players like OpenAI ($8.3B closed in August) and Anthropic (reportedly raising $10B).

🎭 VivaTech shake-up

Maurice Lévy, the 83-year-old former CEO of Publicis, bought out Publicis’ shares in VivaTech, which now makes him a 50% shareholder alongside Les Echos – Le Parisien Group (LVMH). Lévy has historically been heavily involved in the event, and even moderated the keynote panel for the 2025 event featuring NVIDIA Jensen Huang, Mistral CEO Arthur Mensch, and President Emmanuel Macron.

🔑 Alice & Bob makes a quantum leaps

French Quantum darling Alice & Bob in partnership with Inria unveiled a breakthrough method for producing “magic states” in electrons, which could cut qubit requirements by roughly 8X. That’s not quite “quantum supremacy,” but it’s a real stride toward making fault-tolerant quantum computers practical.

🏦 BNP goes French Tech

BNP Paribas has joined the “Je choisis la French Tech” program and will commit parts of its procurement budgets to French startups and scaleups. The second largest bank in Europe is now the latest of more than 600 companies who have signed onto the initiative in the last two year.

🧪 Abivax raised $747M with their US share offering

Ok, technically this news was from the end of July, but it may have slid under the radar and it’s a story worth knowing about. Founded in 2013, Abivax recently published positive phase 3 test results for Obefazimod, its drug to combat ulcerative colitis. The good news saw their stock skyrocket in value by 580% in a single day. To capitalize on their new $6 billion valuation, Abivax made additional shares available to the public and raised an eye-watering $747 million in the process.

🚀 Infinite Orbits signs €50M defense contract

Toulouse-based space startup Infinite Orbits signed a €50M contract to provide in-orbit servicing and surveillance for the French Ministry of Defense starting in 2027. It’s another sign of Europe’s growing space-defense crossover, where satellites aren’t just for comms but double as strategic assets.

🤗 Open AI releases open source model with Hugging Face

OpenAI surprised everyone this summer by open-sourcing a new model on Hugging Face, with CEO Sam Altman framing it as a bridge to the open-source community. Clement Delangue of Hugging Face described the move as “the beginning of a new era of collaboration.” For French AI players this partnership may also raise the stakes as the moat around open-source evolves and Mistral is no longer the only large LLM company playing that card.

🇪🇺 Macron vs. Trump, Round Two

To close out the summer, Macron warned that France and the EU will retaliate if Trump enforces new tariffs on European digital services. At the core of his message is the promise Europe won’t back down on digital sovereignty, even if American big tech gets caught in the crossfire.

🌎 Stories from around the world

💰 Anthropic and Open AI are raising billions

The AI arms race saw an infusion of fresh ammunition this summer with OpenAI closing $8.3 billion of a planned $40 billion round while competitor Anthropic is reportedly pursuing $10 billion in new funding. With estimated recurring revenues of $13 billion and $5 billion each the new rounds, and the valuations they’re raising at, reflect continued optimism (some would say overhype) in supporting the foundation model space.

📈 Ramp’s valuation increased by $6.5 billion in 45 days

I’m not sure which is more surprising here, that the American B2B fintech saw its valuation rise 40% in just 45 days or that the new valuation came alongside a $500 million investment which follows the earlier $200 million round in June. Ramp looks a lot like Qonto for Americans, combining business banking with financial tools for expense management, invoicing, etc. But, with ≈7% the number of clients as Qonto, Ramp is still able to command a significantly higher valuation by focusing on larger companies and rapid introduction of agentic AI into their products.

🦄 Unicorn funding is back

I haven’t gotten to use the unicorn emoji in awhile, but after a sharp slowdown late-stage rounds are flowing again for unicorn companies…at least on a global level. Deal volume is still lower than the 2021 peak, but capital is flowing with an average 2025 deal size of $490M compared to $260M in 2021.

🚀 Germany’s n8n blew past unicorn status

Berlin-based automation platform n8n closed a new round with Accel which saw the startup reach a $2.3B valuation, up from $350M just four months ago. The no-code darling turned AI juggernaut is now Europe’s newest unicorn story of the summer, hot on the heels of Lovable’s $200M raise in July a $1.8 billion valuation. The pace is only getting faster, with Lovable reportedly receiving new offers at a $4 billion valuation just last month.

👚 Shein finally filed for an IPO

Fast-fashion giant Shein officially filed for its long-anticipated IPO in Hong Kong. The listing will be a sharp test of whether public markets will embrace the global e-commerce phenom with both its massive growth and the equally massive scrutiny that comes with it.

🤝 Meta and Google signed a mega-deal

Meta tapped Google for a six‑year cloud deal that surpasses $10 billion and will cement Google as the backend engine for Meta’s AI tooling. This is Google’s second mega‑deal this summer following a previously announced cloud partnership with OpenAI.

👨⚖️ FTC pushed back on EU/UK encryption laws

The U.S. FTC urged 13 big tech companies, including Apple, Google, Meta, and Amazon to resist UK and EU pressure to weaken encryption or censor content on their platforms and called the EU Digital Service Act an attempt to "censor content or degrade security for users” which would violate US law. So yeah, everyone is still getting along really well this year.

🤑 Nvidia is chasing trillions

Nvidia has once again surpassed a $4 trillion valuation following its August 27 earnings announcement. Back in 2018, Apple was the first public company to break the $1 trillion valuation ceiling on revenues of $265 billion. Now, analysts are kicking around the possibility of $1 trillion in revenue for Nvidia within the next 5 years. (Is AI over-hyped? You be the judge). At current EV/revenue multiples, that would value the chip maker at $25 trillion, or roughly 40% the valuation of the US’ entire stock market today. Interestingly, Nvidia’s latest earnings report also revealed that 39% of their revenue comes from just two anonymous mega-customers.

🍌 Meet Nano Banana, the “Adobe killer”

Despite having one of the silliest names in recent memory, Google Gemini’s 2.5 Flash Image model (nicknamed Nano Banana) has got the internet buzzing about the death of Photoshop. The new model costs just $0.039 per image and boasts impressive character consistency and the ability to combine multiple reference photos in what is essentially the AI equivalent of photoshopping an image together.

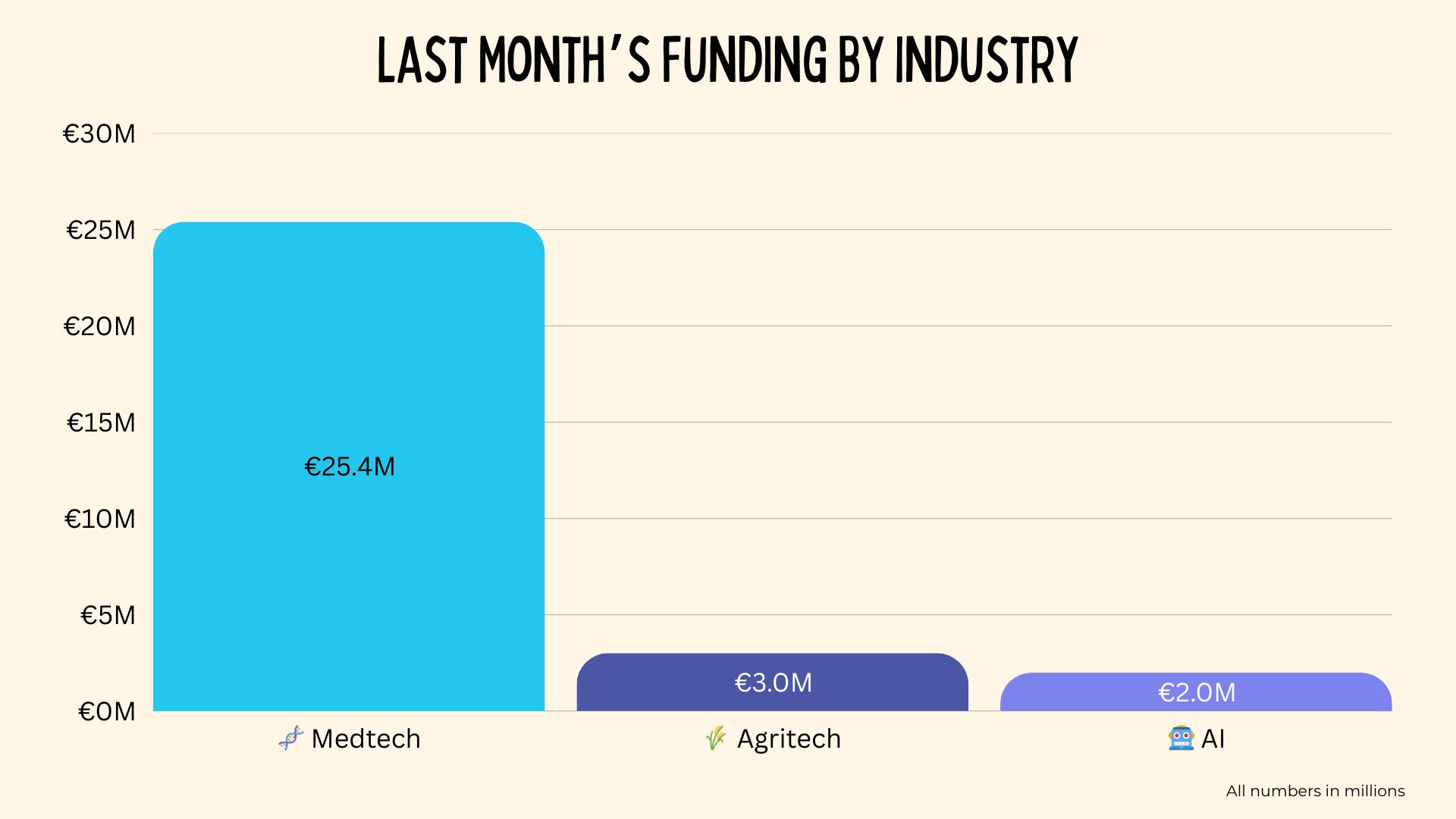

New Funding 💶

5 companies announced €30.39M in new funding in August.

MagicPost | €690K | 🤖 AI

Paris-based MagicPost has raised €690,000 to grow its AI-driven LinkedIn content creation platform. The round combines €260K in equity with €430K in non-dilutive funding from Bpifrance and a bank loan. The tool helps users draft, edit, and track posts, and is already used by clients like Saint-Gobain and Audencia.

Rewayz | €1.3M | 📊 AI SaaS

Lille-based Rewayz has raised €1.3 million from business angels in support of its AI-powered coaching tool for managers. The startup, founded in 2022, offers a virtual assistant that analyzes employee feedback and suggests personalized management actions, aiming to boost engagement and reduce turnover. High-profile backers now include Thierry Mulliez (Association Familiale Mulliez) and Jean-Michel Aulas (Cegid Group). Already used by Burger King, Total, and Leroy Merlin, Rewayz is eyeing international expansion and profitability by 2026.

VitaDX | €1.5M | 🧬 Medtech

Rennes/Paris-based medtech VitaDX has raised €1.5 million to expand deployment of its bladder cancer diagnostic test, particularly targeting the U.S. market. The round was backed by existing investors Go Capital and Odyssée Venture, along with new entrants. Alongside the fundraising, the company has appointed Fabrice Beauchêne as CEO, with co-founder Allan Rodriguez transitioning to board chair.

Praysbee | €3M | 🌾 Agritech

Bordeaux-area startup Praysbee has raised €3 million in a round led by Demeter’s VitiRev Innovation fund, with backing from regional investor NACO. The company develops Wulp, a retrofitted spraying system for vineyards that reduces chemical drift by over 90%, uses 66% less fuel, and is blower-free. The funds will scale up production and expand deployment across France and internationally—especially in tightly regulated regions like Cognac.

Median Technologies | €23.9M | 🧬 Medtech

Valbonne-based Median Technologies has raised €23.9 million to support the U.S. launch of its AI-powered lung cancer screening software, eyonis® LCS. With FDA and CE mark filings in progress, the company is positioning itself as a major player in oncology diagnostics using intelligent imaging. This funding also unlocks access to a €19M tranche from the European Investment Bank.

Upcoming Events 🗓

Dreamina AI & CapCut present: Chroma Awards Meetup @Paris – September 1

Climate Tech Cocktails: Paris Edition – September 3

Founders Running Club, Paris – September 6

LangChain Presents: AI Agents Meetup in Paris – September 8

Aleo x Crypto Mondays – September 8

Serena Run Club #9 - Back to School Edition – September 8

Paris inference & vLLM meetup #2 – September 15

The Audiencers Festival, Paris – September 15

The AI Art Magazine Vol.2 launching event – September 19

AI Engineer Paris Conference – September 23-24

{Tech: Europe} Paris AI Hackathon – September 27

Interesting Jobs 👩💻

What Else I’m Reading 📚

The New Economics of M&A: Acquiring AI teams is now 6X more expensive (Axel Badalian)

The Great European Summer: Bad for Business? (Sifted)

A New Interstellar Propulsion Method: T.A.R.S. (Cool Worlds)

TechpressoThe Great European Why you’ll like it: Daily updates on the latest tech and AI news in an easy-to-read format. Stay in the know while finishing your morning coffee. | Trends.vc Why you’ll like it: Short summaries of breaking topics in the world of startups and Venture Capital. An easy way to find new ideas and opportunities. |