- French Tech Updates

- Posts

- 🇫🇷 French Tech Updates — July 21, 2025. €44.5M in new funding for French companies.

🇫🇷 French Tech Updates — July 21, 2025. €44.5M in new funding for French companies.

What you need to know this week in France: 💰 €650M for Eurazeo’s new growth fund, 💔 disappointment for EU Inc. 🇫🇷 another French budget debate.

Welcome to French Tech Updates! Your weekly source of startup, VC, and tech news and insights. I’m James, a startup-obsessed American living in Paris.

Back in the EU ✈️

I spent the last week in Boston for my brother-in-law’s wedding, which means I got to watch the fallout of the European Parliament’s latest EU Inc. proposal from afar.

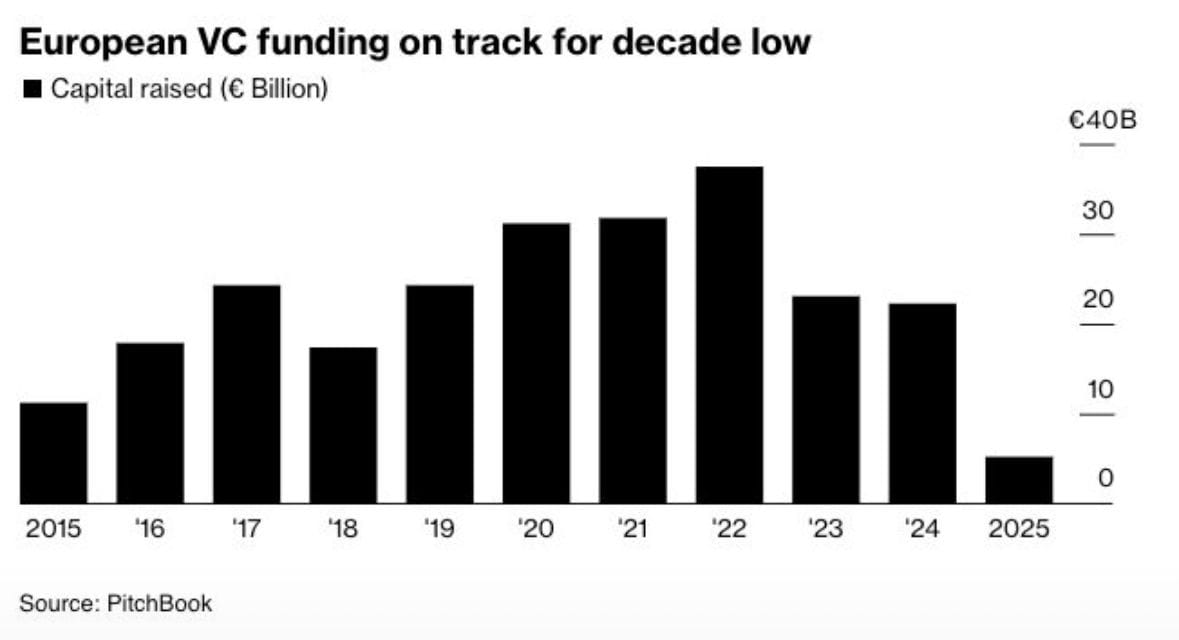

From across the Atlantic this latest failure to improve conditions for European startups looks comically bad. In between horror stories of 5-figure notary bills and decade-low funding for VCs it’s not surprising that more and more European founders are shifting their focus to the US. While not without its many flaws, it is a whole lot easier to start and grow a company in The States.

The flight to America will continue at Europe’s expense unless the EU Parliament can stop EU’ing and actually improve conditions for startups…or until the current US administration manages to fully shoot itself in the foot and further cut off the flows of talent into the country.

On that happy note, let’s jump into this week’s update!

📊 Chart of the day

What’s new this week in 🇫🇷

The movement, which aims to create a “28th regime” to help European founders overcome the challenges posed by the current fragmented EU market has run into difficulties in the European Parliament.

To be fair, these challenges are not the fault of the movement’s leaders, but rather the EU leadership whose vague language and numerous loopholes falls short of what the European startup community expected. The resulting proposal has left founders feeling underwhelmed (or maybe just whelmed).

On July 15, the day after Bastille Day, Prime Minister François Bayrou revealed the latest budget plan, which aims to deliver €43 billion in savings and reduce the budget deficit to 4.6% of GDP by the end of next year (The EU allows for a maximum deficit of 3% of GDP, which France has been above since 2019).

In addition to removing two holidays and shifting health care costs to the public, the proposal would also set aside an additional €900M in equity financing for startups, reduce subsidies alongside “obligations, constraints, and bureaucracy,” and create a new “solidarity contribution” tax targeting the highest earners.

Will this latest proposal lead to the 9th no confidence vote against Bayrou? Probably. Will we get a budget at the end of this mess? Seul l'avenir le dira.

This latest fund comes two years after four senior members of the Growth team left Eurazeo in 2023. The growth vehicle will deploy tickets ranging from €20-€100M in size, although the criteria for the fund’s investments are shifting due to AI.

Previously, the bar for a company to be considered as part of Eurazeo’s growth funds was €10M in annual revenue. With rapid growth from AI, that bar is being raised due to perceived risk in rapidly growing revenues of some young AI companies.

“We’re not here to take risks on a product or on a market, but on the execution for the company’s future growth” said managing director Halal Fadel. LPs in the fund are a mix of public (European Investment Fund) and private sources.

🌍 Headlines from around the world

🌊 Google makes a $3 billion hydropower deal (The Guardian)

🎧 DJ-duo The Chainsmokers close their $100M third venture fund (Music Business Worldwide)

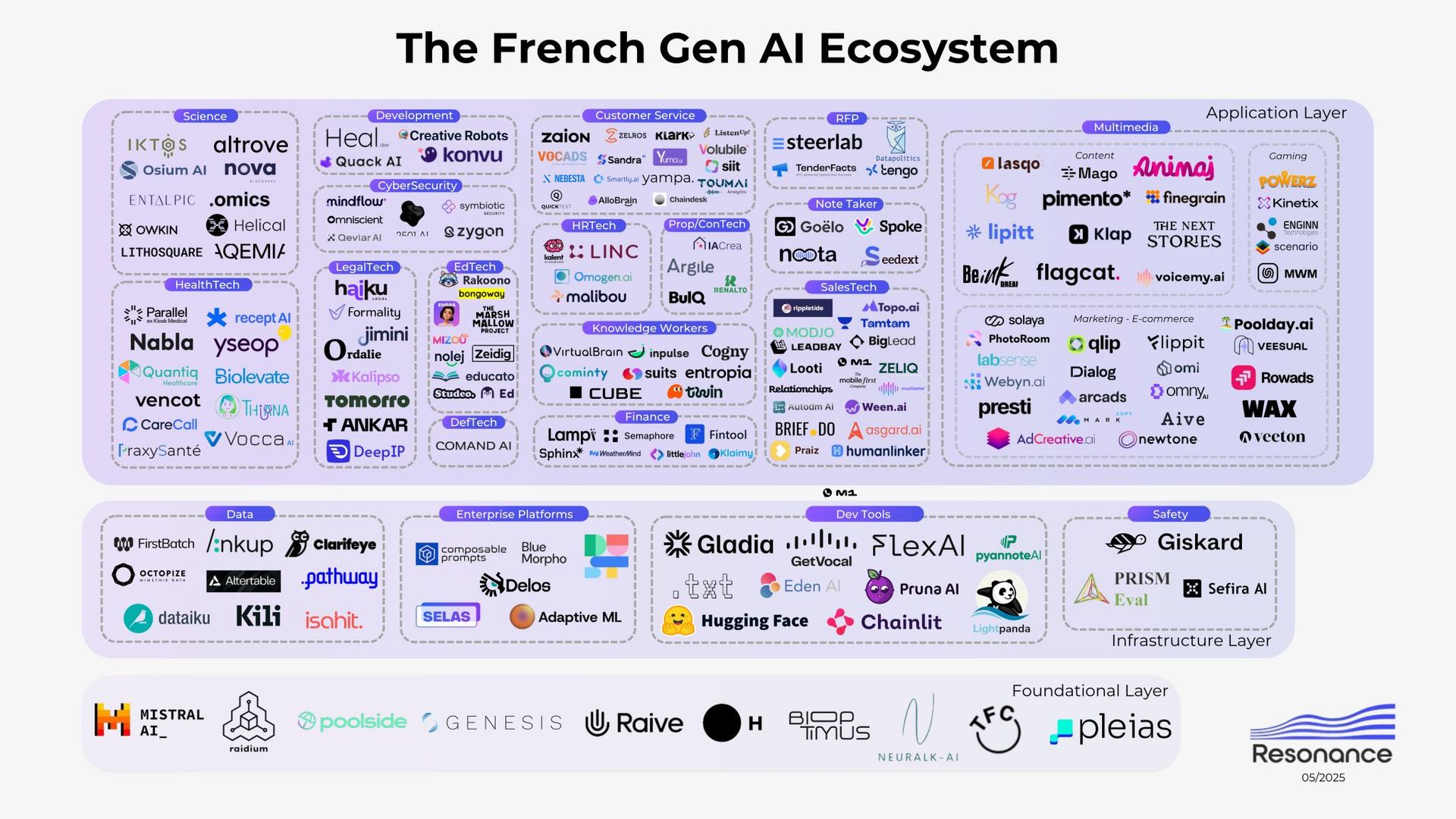

🗣️ Mistral debuts Voxtral, its first open source, multi-lingual AI audio model (Mistral)

🤖 Amazon gets in on the AI coding craze with Kiro, its new IDE (Forbes)

🤑 Anthropic plans to raise a new round at a $100 billion valuation (The Information)

🚀 Swedish “vibe-coding” platform Lovable hits unicorn status 8 months after launching (Tech Crunch)

🦄 Substack reaches $1 billion valuation with latest fundraising (EMarketerz)

New Funding 💶

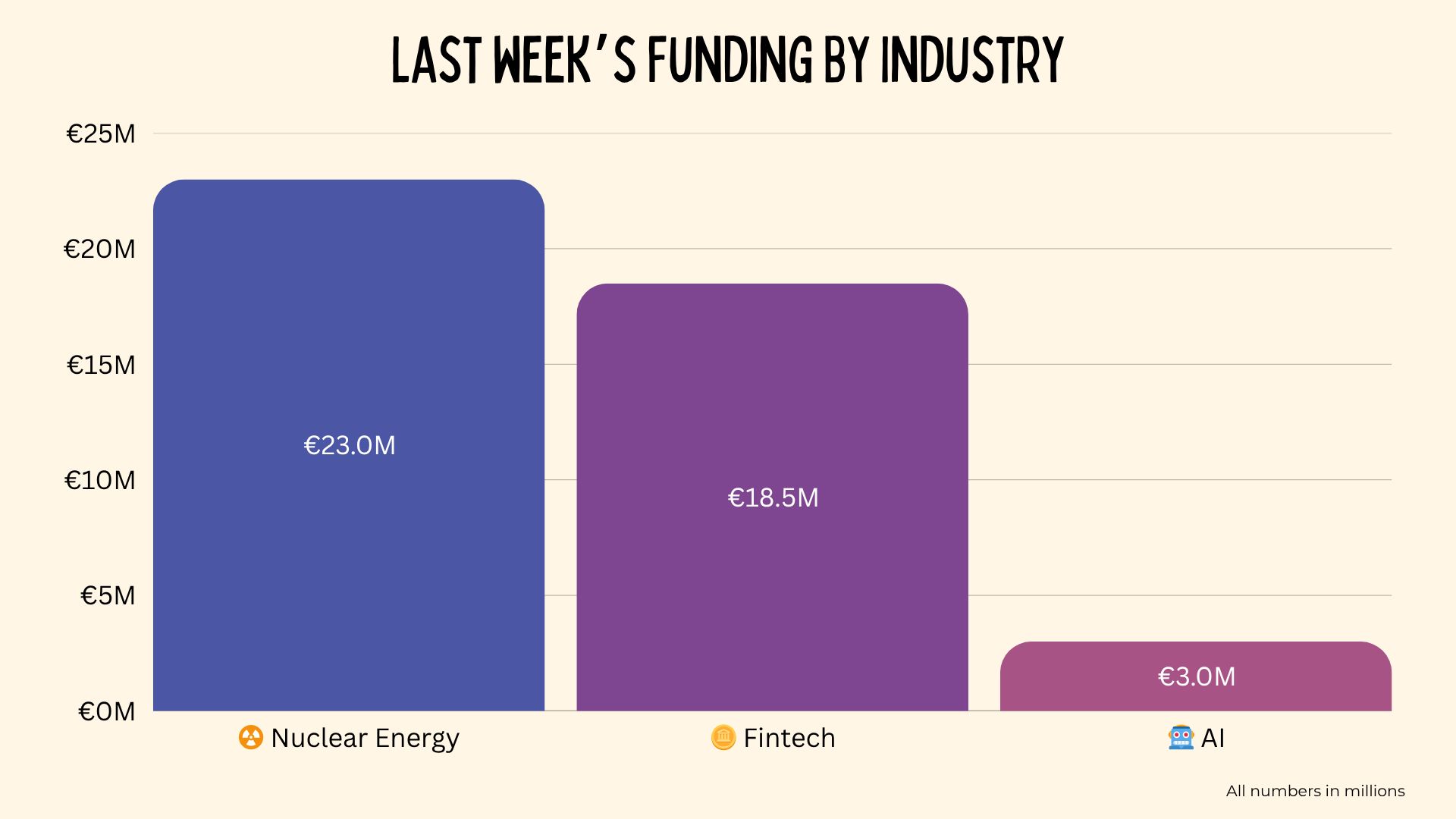

3 companies announced €44.5 million in new funding last week.

Retab | €3M | 🤖 AI

Retab has raised €3 million ($3.5 million) to build a platform that detects and corrects errors from generative AI models in real time. The round was led by VentureFriends, with backing from Kima Ventures, K5 Global, and prominent tech figures including Éric Schmidt and Xavier Niel. Retab’s tool helps developers improve AI accuracy by layering an oversight system on top of existing large language models.

Spiko | €18.5M | 🪙 Fintech

Spiko has raised €18.5 million in a Series A round led by Index Ventures, with backing from Bpifrance, Frst, White Star Capital, and several fintech founders. The startup offers tokenized money market funds that let European businesses earn daily interest on idle cash with full liquidity. With €300 million under management and partnerships with Memo Bank and Fygr Spiko aims to expand across Europe.

Stellaria | €23M | ☢️ Nuclear Energy

Isère-based Stellaria secured €23 million in Series A financing led by US fund At One Ventures and France’s Supernova Invest, with follow-on backing from CEA Investissement, Schneider Electric, Exergon and Technip Energies. The deep-tech startup is developing Stellarium, a molten-salt nuclear reactor designed to supply heavy industries with low-carbon, self-fueling power. The money, plus €10 million in France 2030 grants, will fund technical and regulatory work ahead of a first pilot in 2029.

Upcoming Events 🗓

Interesting Jobs 👩💻

What Else I’m Reading 📚

TechpressoWhy you’ll like it: Daily updates on the latest tech and AI news in an easy-to-read format. Stay in the know while finishing your morning coffee. | Trends.vc Why you’ll like it: Short summaries of breaking topics in the world of startups and Venture Capital. An easy way to find new ideas and opportunities. |