- French Tech Updates

- Posts

- 🇫🇷 French Tech Updates — December 8, 2025. €642.7M in new funding for French companies.

🇫🇷 French Tech Updates — December 8, 2025. €642.7M in new funding for French companies.

What you need to know this week in France: 🤖 Mistral’s robotics play, 🪦 RIP Ÿnsect, 💰 €75M in new VC capital, 🧬 The “Station F” of cancer research.

Welcome to French Tech Updates! Your weekly source of startup, VC, and tech news and insights. I’m James, a startup-obsessed American living in Paris.

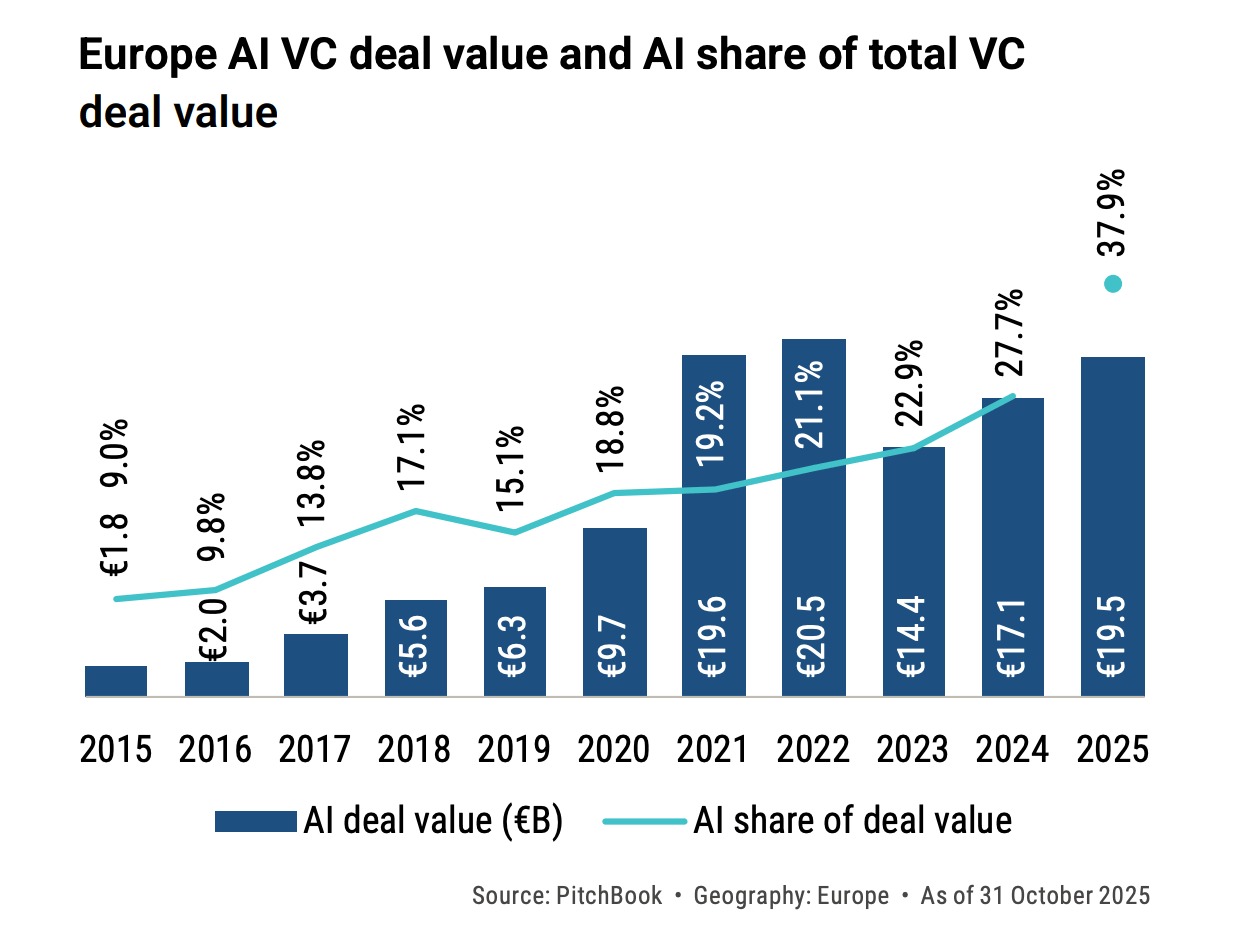

📝 Quiz: What % of VC deal value in EMEA has gone to AI rounds in 2025?

(answer at the bottom of the newsletter)

A.) 23%

B.) 38%

C.) 43%

D.) 52%

What’s new this week in 🇫🇷

The company’s latest batch of 10 multi-modal open-weight models released last Tuesday prioritize efficiency and flexibility over raw power. The release represents Mistral’s latest move to carve out a sustainable moat against aggressive, capital-flush global competition.

Mistral 3 can be run on a single GPU, which means it can more easily be adapted to the physical world and carried onboard a robot or vehicle.

This adaptability to physical applications may be the key differentiator for Mistral, who also setup an internal team focused on the robotics space—a sector that’s having a bit of a moment lately.

After 14 years in operation and a lengthy debt struggle that began last September, the embattled insect protein company is finally being liquidated. The company leaves behind its now abandoned 45,000m² Ÿnfarm facility, 43 employees looking for new jobs, and a black mark on the alternative protein sector as a whole.

After raising €600M in investor capital, Ÿnsect failed to achieve sustainable production, despite fighting it out to the bitter end.

The shutdown marks a disappointing end for a company French Minister of the Ecological Transition Barbara Pompili once described as “an example of reindustrialization and job creation made possible by transitioning to environmentally-friendly policies” and will likely give investors pause before they again fund new projects requiring large industrial buildouts.

One of my theories of fintech is that you either die young or live long enough to launch a credit offering. Silvr started off with the credit offering and died young anyway.

The company launched in 2020 with a lending product for SMEs. In 2022 they raised a €18M Series A plus a €112M credit line, in 2023 they secured an additional €200M credit facility, but by June of this year they had entered into receivership.

The Silvr story ended last week with the company being bought by Paris-based competitor Karmen for an undisclosed sum.

ISAI Ventures IV began raising funds five months ago with the same €100M target size as fund III, which closed in 2020 at an oversubscribed total of €120M. Backers in this latest vehicle for the 15-year-old VC include Bpifrance and multiple individual entrepreneurs alongside institutional capital and family offices.

Fund IV will primarily invest tickets from €1M-€3M with 10% of capital allocated to pre-seed rounds starting at a €100K ticket size. 80% of the funds will be deployed in France with the remaining 20% prioritized for French founders building their companies abroad (with an emphasize on French founders in the US).

The massive space, which eventually plans to expand to 100,000m² is known as The Hive. Early tenants include Signadori Bio, Valerio Therapeutics, and Orakl Oncology— all of which are focused on developing next-generation cancer treatments.

The campus intends to speed up clinical research by clustering labs, services, and researchers in one ecosystem à la Station F.

🌍 Headlines from around the world

🤖 Amazon previews 3 “frontier agents” for software development (Amazon)

🚨 OpenAI declares internal “code red” in response to rising pressure from competitors like Google’s Gemini 3 (Yahoo Finance)

🍎 Apple AI chief steps down following Siri setbacks (The Verge)

🏢 Instagram mandates total return to office for employees in 2026 (Engadget)

⛓️💥 AI agents find $4.6M in blockchain smart contract exploits (red.anthropic.com)

🎫 Bending Spoons acquires Eventbrite for ≈$500M (The Information)

🪙 BNP Paribas joins the European consortium for the launch of a euro-backed stablecoin (Boursier)

📺 Netflix to acquire Warner Brothers for $72B (Reuters)

New Funding 💶

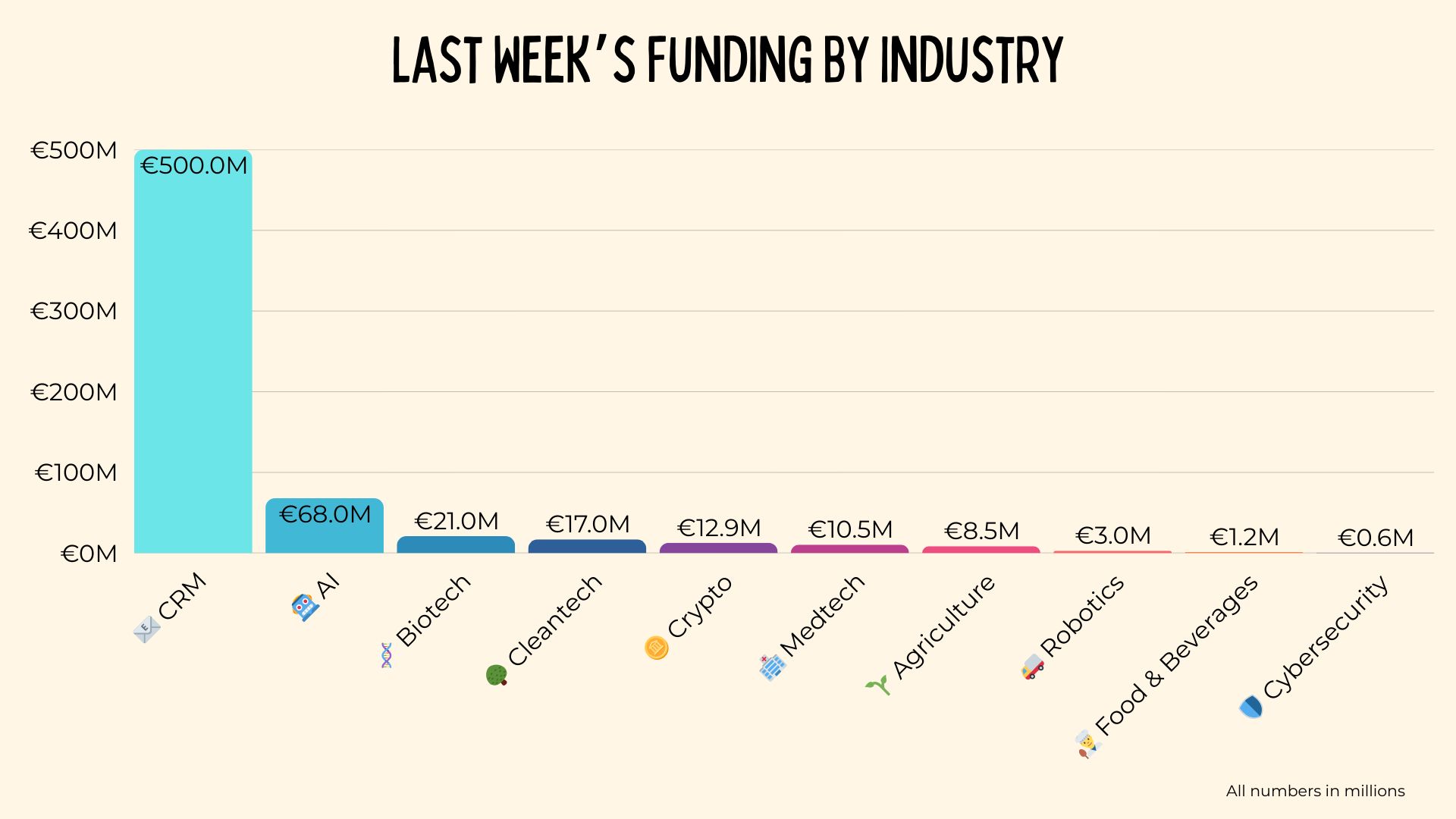

15 companies announced €642.7M in new funding last week €600K by Vaultys (🛡️ Cybersecurity) and €500K by Vulgaroo (🏥 Medtech).

BiPER Therapeutics | €1M | 🧬 Biotech

Strasbourg-based BiPER Therapeutics raised €1 million to advance its lead cancer drug candidate into clinical trials. The company is developing oral small molecules that target BiP, a protein linked to cancer cell survival, using an approach designed to overstress diseased cells. Part of the funding will also support a new AI-enhanced R&D center in Tunisia.

Komia | €1.2M | 👨🍳 Food & Beverages

Lyon-based Komia raised €1.2 million in a round backed by Bpifrance, Réseau Entreprendre Rhône, and footballers Aurélien Tchouaméni and Jules Koundé. The startup provides software to help restaurants manage operations, track margins, and forecast demand. The funds will support team expansion and further development of its predictive tools.

Ventuno Biotech | €2M | 🧬 Biotech

Lyon-based Ventuno Biotech raised €2 million in a seed round combining €2 million in equity from Octalfa, Relyens Innovation Santé, and business angels and supported by a further €1 million in debt from Caisse d’Epargne Rhône Alpes and BNP Paribas Innovation. The startup is developing new immunotherapies that aim to help the immune system fight cancers resistant to current treatments.

Rob’Occ | €3M | 🚚 Robotics

Rob'Occ, based in Brens, raised €3 million from a group of Franco-Swiss business angels and regional investors including Occibot Industries and Tarn Capital Investissement. The startup builds assistant robots that automate tasks like internal transport in factories, shops, and warehouses. The funding will help it ramp up hiring and accelerate sales in France and Europe.

ReSoil | €4M | 🌱 Agriculture

Paris-based ReSoil raised €4 million from Banque des Territoires, INCO Ventures, and other private investors. The startup helps French farmers transition to regenerative agriculture by offering carbon tracking tools and financial incentives tied to improved environmental practices.

Veragrow | €4.5M | 🌱 Agriculture

Veragrow, based in Val-de-Reuil, raised €4.5 million from Odyssée Venture, Normandie Participations, CEN Innovation, and Groupe All Sun. The startup produces biostimulants made from worm compost to improve crop yields and soil health.

2501.AI | €8M | 🤖 AI

Paris-based 2501.ai has raised €8 million from Cusp Capital, Galion.exe, Axeleo Capital and several angel investors. The startup builds on-premise, multi-agent AI systems that automate real-time monitoring, diagnosis and incident remediation for mission-critical IT environments. The team, led by Alexandre Pereira and Alex Zhuk, is also expanding to New York as it scales internationally.

Sim&Cure | €10M | 🏥 Medtech

Montpellier-based Sim&Cure raised €10 million in an extension to their €3.1 million raise from April of this year. The new round is backed by Elaia, IT Translation Investissement, Sofilaro, and others and will support continued growth for Sim&Cure’s software that helps doctors plan brain aneurysm surgeries using AI and digital twins. The funding will be used for global expansion (especially in Asia) and to boost R&D and commercial growth efforts.

Bitstack | €12.9M | 🪙 Crypto

Paris-based Bitstack raised €12.9 million ($15 million) in a Series A round led by 13books Capital with participation from AG2R LA MONDIALE, Plug and Play Ventures, Serena, Stillmark, and Y Combinator. The startup, which was part of YC’s summer 2022 batch, offers a mobile app that lets users automatically round up everyday purchases and invest the difference in Bitcoin. The funds will support its expansion across Europe and the launch of a Bitcoin rewards debit card.

Spark Cleantech | €17M | 🌳 Cleantech

Paris-based Spark Cleantech has raised €17 million in Series A funding plus an additional €12 million in debt from 360 Capital, Taranis, the Île-de-France Reindustrialisation Fund and Asterion Ventures.The startup builds systems that split natural gas into hydrogen and solid carbon before it’s burned, allowing industrial sites to cut CO₂ emissions without changing their existing equipment. The new capital will support scale-up, certification of its carbon materials, and its first commercial deployments.

Axoltis Pharma | €18M | 🧬 Biotech

Clermont-Ferrand-based Axoltis Pharma raised €18 million to advance clinical trials of its ALS drug candidate, NX210c. The treatment aims to restore the blood-brain barrier in patients with amyotrophic lateral sclerosis, a neurodegenerative disease with limited therapeutic options. Results from its Phase II trial are expected in mid-2026.

Gradium | €60M | 🤖 AI

Paris-based Gradium raised €60 million in a massive seed round just three months after publicly launching. The spinoff from Kyutai’s open-science AI lab develops voice AI models that process audio directly and skip text transcription in an approach they say improves latency and expressiveness. Founded by ex-Meta and DeepMind researchers, Gradium targets developers with its API product and has seen early traction with gaming, customer service, and healthcare customers.

Brevo | €500M | 📧 CRM

Paris-based Brevo, which offers a cloud‑based CRM and customer‑engagement platform, raised €500 million ($583 million) in fresh funding that values the company at over €1 billion. The round, which is structured more like an exit, was led by General Atlantic and Oakley Capita and existing investor Partech fully exit with other historic investors Bridgepoint and Bpifrance both selling a portion of their shares. For more on the full structure of the deal, The French Tech Journal has more info here.

Upcoming Events 🗓

🆕 The Holiday AI Founders Mixer – December 9

🆕 CTO Voices x Kor : construire un agent clinique best-in-class en 18 mois – December 9

🆕 Créez votre premier agent IA sur Dust | Lion x Paatch – December 10

Pitch Night à Station F – December 11

🆕 Paris Hardware Meetup | Building the Future of Robotics – December 11

🆕 Claude Code Meetup Paris – December 11

🆕 Iterate Voice AI Paris Hack w/ Gradium, Kyutai, pyannoteAI, & more – December 14

Interesting Jobs 👩💻

What Else I’m Reading 📚

The Strange Pattern Behind (Almost) All Extreme Events - The Power Law (Veritasium) – This is the best description of Power Laws I’ve ever come across. There are many excellent takeaways from this video, but my favorite is this one: know which game you’re playing and what gets rewarded. In normal distributions, consistency pays off. In power law distributions (where outcomes can compound) a higher volume of bets increases your chances of outlier rewards. In this way, exercise is about consistency and while investing, writing, etc. are about making a high volume of bets.

TechpressoWhy you’ll like it: Daily updates on the latest tech and AI news in an easy-to-read format. Stay in the know while finishing your morning coffee. | A Smart Bear: LongformWhy you’ll like it: Practical insights from building two unicorn companies, covering product, growth, prioritization, and much more. |

Quiz Answer: B.) 38% (or 37.9% if you’re being exact)